After the initial knee-jerk reaction to the pandemic, technology stocks performed exceptionally well through 2020, as the world moved online for everything that they possibly could, everything that would allow them to keep a safe distance from the rest of mankind and everything that would allow them to carry out their daily routines.

That meant that a whole lot of infrastructure that some people estimate would have been laid in five years, was actually done in a matter of months.

Naturally, technology companies were working overtime and reporting one strong quarter after another. And this sent their shares soaring.

With the first vaccine announcement at year-end and all the other related announcements that followed, people initially expected tech stocks to fall off their 2020 highs. Especially because they’ll now have to deal with difficult comparisons in 2021 because the IT expenditures of 2020 are unlikely to repeat.

But while a correction would definitely be in order (and the market does appear to be moving in that direction), we can hardly lose sight of the fact that no other sector is so central to increasing the efficiency and effectiveness of all other sectors. So if there is growth in the other sectors, there will be growth in technology as well.

Moreover, with artificial intelligence coming of age, no company can afford to avoid the technology because that will be a huge setback to its own growth and competitiveness.

That’s why, in a nutshell, the tech sector remains a good hunting ground for stocks.

If you’re wary of losses, you can go for stocks that promise strong growth and also pay a dividend. I’ve selected a few in this category that you may want to consider-

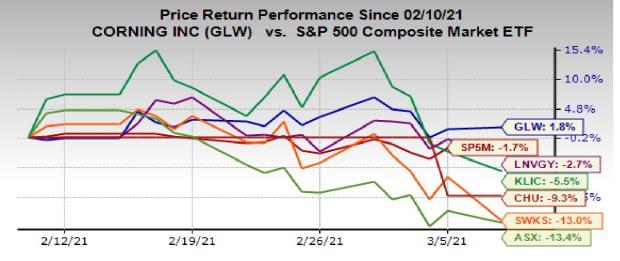

Corning Inc. (GLW – Free Report)

New York-based Corning started out as a glass business that was reincorporated in 1936. The company currently produces advanced glass substrates covering displays in flat panel TVs, monitors, notebooks and smartphones. It also offers a range of other materials and products used in lab equipment and automotive pollution control systems.

Zacks Rank #2

Value Score B, Growth Score C,

Industry: Communication – Components (top 21%)

Revenue and EPS expected to grow 14.7% and 37.4%, respectively in 2021.

Revenue and EPS expected to grow 4.5% and 12.7%, respectively in 2022.

It pays a dividend that yields 2.6%.

Its forward P/E of 19.6X is reasonable.

Kulicke and Soffa Industries, Inc. (KLIC – Free Report)

Kulicke & Soffa is a leading provider of semiconductor packaging and electronic assembly solutions supporting the global automotive, consumer, communications, computing and industrial segments. As a pioneer in the semiconductor space, K&S has provided customers with market leading packaging solutions for decades.

In recent years, K&S has expanded its product offerings through strategic acquisitions and organic development, adding advanced packaging, electronics assembly, wedge bonding and a broader range of expendable tools to its core offerings.

Zacks Rank #1

Value Score D, Growth Score A

Industry: Electronics – Manufacturing Machinery (top 6%)

Revenue and EPS expected to grow 78.1% and 234.7%, respectively in 2021 (ending September).

Revenue and EPS expected to grow 3.5% and -5.5%, respectively in 2022 (despite the decline, the EPS is expected to remain more than 3X the 2020 EPS of 95 cents).

It pays a dividend that yields 1.3%.

Its forward P/E of 13.9X is reasonable.

Skyworks Solutions, Inc. (SWKS – Free Report)

Irvine, CA-based Skyworks Solutions designs, manufactures, and markets a broad range of high-performance analog and mixed signal semiconductors that enable wireless connectivity.

The company’s products include power amplifiers (PAs), front-end modules (FEMs), radio frequency (RF) sub-systems and cellular systems. Leveraging its core analog technologies, the company also offers a diverse portfolio of linear integrated circuits (ICs) targeting automotive, broadband, cellular infrastructure, industrial and medical applications.

Zacks Rank #1

Value Score D, Growth Score A

Industry: Semiconductors – Radio Frequency (top 33%)

Revenue and EPS expected to grow 46.8% and 67.5%, respectively in 2021 (ending September).

Revenue and EPS expected to grow 3.9% and 5.2%, respectively in 2022.

It pays a dividend that yields 1.2%.

Its forward P/E of 16.9X is reasonable.

Lenovo Group Ltd. (LNVGY – Free Report)

Hong Kong-based Lenovo, a personal technology company with a focus on PCs and mobile internet devices, was formed by Lenovo Group’s acquisition of the former IBM Personal Computing Division. Its product lines include the Think-branded commercial PCs, Idea-branded consumer PCs, as well as servers, workstations and mobile internet devices like tablets and smart phones. Lenovo has major research centers in Yamato, Japan; Beijing, Shanghai and Shenzhen, China; and Raleigh, North Carolina.

Zacks Rank #1

Value Score A, Growth Score A

Industry: Computer – Mini computers (top 8%)

Revenue and EPS expected to grow 18.2% and 90.8%, respectively in 2021 (ending March).

Revenue and EPS expected to grow 2.8% and 6.5%, respectively in 2022.

It pays a dividend that yields 1.2%.

Its forward P/E of 12.4X is reasonable.

ASE Technology Holding Co., Ltd. (ASX – Free Report)

Taiwan-based ASE Technology offers backend semiconductor manufacturing services in assembly and testing. Its services include front-end engineering testing, wafer probing and final testing as well as IC packaging, and materials and electronic manufacturing services. It operates primarily in Taiwan, China, South Korea, Japan, Singapore, Malaysia, Mexico, United States and Europe.

Zacks Rank #2

Value Score A, Growth Score A,

Industry: Electronics – Semiconductors (top 25%)

Revenue growth estimates aren’t available.

EPS is expected to grow a respective 39.5% and 10.0% in 2021 and 2022.

It pays a dividend that yields 1.2%.

Its forward P/E of 12.3X is reasonable.

China Unicom Hong Kong Ltd. (CHU – Free Report)

China Unicom Limited is engaged in the provision of cellular, paging, long distance, data and Internet services in the People’s Repulic of China.

Zacks Rank #2

Value Score A, Growth Score C

Industry: Wireless Non-US (bottom 11%)

Revenue and EPS expected to grow 8.3% and 79.3%, respectively in 2021.

Revenue and EPS expected to grow 4.9% and 23.2%, respectively in 2022.

It pays a dividend that yields 3.4%.

Its forward P/E of 5.8X is very cheap.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.