As 5G wireless technology continues to gain a foothold in the U.S. and worldwide, a top selling point for consumers is the uber-fast download speeds to smartphones that eventually could rival those of landline cable or fiber optic networks.

Achieving those speeds, however, requires handling myriad airwave frequencies and radio channels to deliver better data rates to the phone. And that has put the spotlight on a relatively small group of semiconductor makers who provide filters, amplifiers, switches, low noise receivers, antenna modules and other components known as the radio frequency — RF— front end.

Two companies in San Diego are key players in the RF front end market. Qualcomm, known for cellular modem processors that handle command and control between cellphones to base stations, has developed a significant RF front end business, with most of its momentum centered on new 5G phones.

Smartphone makers including Samsung, LG, Xiaomi, Vivo, Sharp, Nubia and OnePlus use Qualcomm’s modem processors and RF front end chips.

And pSemi, a long-time San Diego company that is now owned by Japan’s Murata, is a top maker of switches, low-noise receivers, power amplifiers and other components that are included in Murata’s RF front end modules.

Over the past three decades, pSemi has shipped more than 6 billion of these chips, and it expects that number to continue growing with the added complexity of 5G.

“San Diego’s contribution to 5G is amazing,” said Sumit Tomar, chief executive of pSemi. “Getting RF right is extremely challenging. We call it magic. That is what we do here. That is what pSemi has been doing for 30 years.”

pSemi supplies components used in modules for Japanese electronics giaint Murata, its parent.

(pSemi)

In smartphones, pSemi has a substantial RF front end footprint in 3G and 4G devices, which are complex in their own right. It counts Samsung, Apple and others as customers.

The company, which employs roughly 400 workers in San Diego, expected $450 million to $500 million in revenue this year. Its compound annual growth rate recently is 30 percent, said Tomar.

“Last year we shipped 700 million (components) and this year we will ship 1.8 billion,” he said. “So you can see the scale at which we are growing.”

But the coronavirus pandemic has taken a bite out of Tomar’s expectations. Industry analysts now believe smartphone sales will slip 15 percent to 20 percent globally.

pSemi Chief Executive Sumit Tomar

Still, pSemi has continued to operate as an essential business during the local shelter-in-place orders, shipping about 3 million to 4 million chips per day. It hasn’t laid any workers off related to the crisis.

“We have 100 plus in San Diego who are working three shifts,” he said. “We are classified as essential because our integrated circuits are used in base stations, smartphones, cable modems and laptops.”

RF front end components are not big or packed with hefty processing power. But they’re important to signal routing and filtering across more than 50 defined frequency bands used for 2G, 3G, 4G and now 5G devices globally.

“They do things like amplification of weak received signals, frequency filtering to cut out radio interference signals and power amplification to generate a strong enough signal to reach the base station,” said Christopher Taylor, an analyst at industry research firm Strategy Analytics.

To support mobile video and gaming on smartphones, the cellular industry rolled out additional complicated techniques to move more data.

Those technologies include carrier aggregation, which receives or transmits data over more than one airwave band at once, and multiple input-multiple output, or MIMO, which receives or transmits on more than one antenna at once, said Taylor.

RF front end components perform quite a bit of signal routing to enable carrier aggregation and MIMO to boost mobile bandwidth.

5G brings in a whole new set of airwave bands that further increase complexity, including high-frequency millimeter wave spectrum.

“I still think the market for RF front end components will grow over the next few years with greater penetration of 4G and 5G,” said Taylor. “But it now appears that the market will be flat or decline slightly in 2020 as a result of COVID-19. Growth should return at 5 percent plus a year in 2021.”

Qualcomm’s latest 5G cellular modem chip and RF antenna module.

In addition to Qualcomm and pSemi/Murata, a handful of other companies supply RF front end technologies, including Qorvo and Skyworks.

“It’s a very competitive business, and it’s very complex, so there are not that many players, which is a good thing,” said Tomar. “If there were 30 players, it would not be a sustainable business. But the level of complexity is so great in RF that a company that doesn’t have the experience designing RF can’t deal with the complexity.”

Formerly Peregrine Semiconductor, pSemi’s core innovation involves coupling silicon to an insulator to achieve desired performance.

It started out combining silicon with sapphire. While that’s still roughly a $100 million business for the company, the bulk of its chips today use different insulating materials.

“Silicon on insulator — Peregrine began that journey 30 years ago,” said Rory Moore, the seed round investor and co-founder of the company. “Now silicon on insulator content in these products (smartphones and other consumer electronics) is increasing significantly.”

Murata acquired Peregrine for $465 million in 2014. The companies had a long relationship, with Peregrine supplying components used in Murata’s integrated RF front end modules. It later re-named the operation pSemi.

While pSemi/Murata has a solid footprint in 4G phones, including Apple’s latest iPhone 11 models, Qualcomm has gotten out of the gate first with 5G, said Parv Sharma, an analyst with Counterpoint Research.

Qualcomm is taking a systems-level approach, selling applications/graphics processors, 5G baseband modems and various RF front end components in a package — which aims to help device makers achieve better performance at low power.

“No other supplier comes close to this level of complete and advanced semiconductor offering yet in the 5G space,” said Sharma.

Qualcomm expects its revenue per 5G smartphone to be 1.5 times higher than revenue from 4G devices, thanks to the additional RF front end content and higher prices for 5G modems.

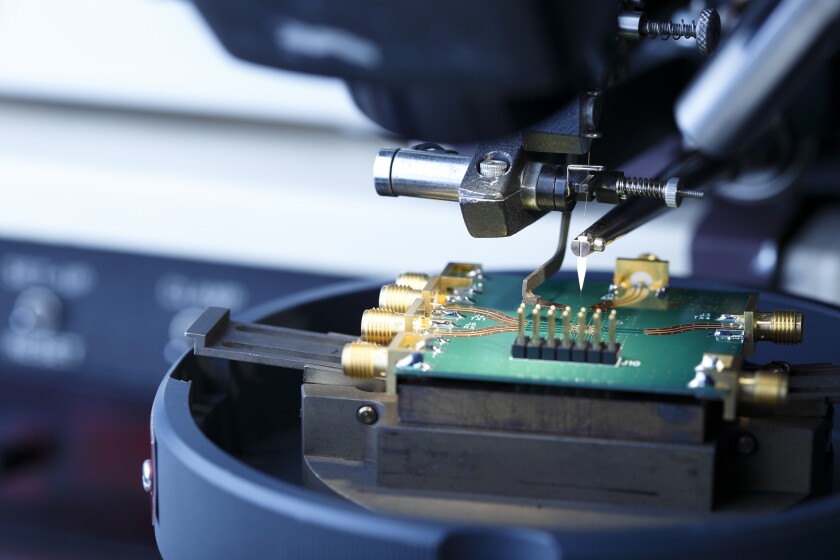

pSemi makes switches and other RF front end components that manage signals in mobile devices.

(pSemi)

“As we continue to execute on our RF Front End strategy, we are pleased to see our RF design win pipeline contribute to the strength of our quarterly results and our outlook,” said Chief Executive Steve Mollenkopf during Qualcomm’s quarterly earnings earlier this year.

Of the roughly 1.7 billion connected devices expected to be sold this year, only about 175 to 225 million are forecast to be 5G smartphones and mobile hotspots, and that number could fall depending on how fast consumers rebound from the coronavirus turmoil.

There are signs, however, that the pandemic has accelerated 5G network deployments in China, Japan, the U.S. and South Korea as stay-at-home orders highlighted the value of fast connectivity for online learning, tele-health and other use cases , said Mike Walkley, an analyst with Canaccord Genuity.

In China, where the outbreak began, smartphone sales in April rebounded significantly in April, with 5G devices making up 40 percent of those shipped.

“Recent data suggests a strong recovery in 5G trends in China during May, and we anticipate steadily recovering global demand,” said Walkley.

For pSemi, it’s 5G development efforts remain on track, said Tomar.

“The number one challenge that we see is not a competitor or technology,” said Tomar. “The No. 1 challenge is talent — not having enough RF engineers. I could do significantly more revenue and product if I could get more engineers.”