Positive earnings outlook has been factored in amid ongoing technological developments that leave little room for future growth prospects

by PRIYA VASU / pic by BLOOMBERG

THE frenzy for technological stocks will likely recede due to little upside in valuations.

The sector is believed to have already factored in a positive earnings outlook amid ongoing technological developments that leave little room for future growth prospects, said AmInvestment Bank Bhd in a research report yesterday that downgraded the sector to ‘Neutral’ from ‘Overweight’.

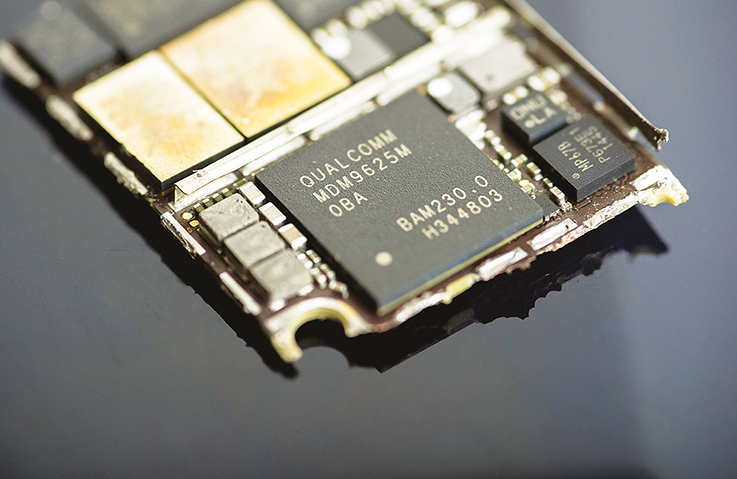

The investment bank added that despite initial supply chain disruptions amid Covid-19 lockdowns and travel restrictions, the sector rebounded to a new high as the pandemic had hastened the progress of technological change towards remote work and distance learning; the need for IR4.0 technologies such as big data, automation and Internet of Things to build a more resilient supply chain; the adoption of 5G as well as investments in expanding 5G networks globally; and electric vehicles (EVs) with more interest on new technologies such as silicon carbide (SiC) and gallium nitrite (GaN).

AmInvestment noted that the downgrade is based on the valuations under its coverage such as the Globetronics Technology Bhd (‘Hold’, fair value [FV] RM2.52), Inari Amertron Bhd (‘Buy’, FV RM2.78) and Malaysian Pacific Industries Bhd (MPI) (‘Hold’, FV RM23.23).

“Their target price earnings (PEs) range from 21 times to 28 times, pegged against our outsourced semiconductor assembly and test benchmark target forward PE of 28 times, which represents a 20% premium above the sector’s three-year historical forward PE of 23 times,” AmInvestment stated.

In the automated test equipment (ATE) space, AmInvestment covers Pentamaster Corp Bhd (‘Hold’, FV RM4.77) and ViTrox Corp Bhd (‘Hold’, FV RM11.48) with target PEs ranging 33 times to 35 times, pegged against its ATE benchmark target forward PE of 33 times, a 50% premium above three-year historical forward PE of 22 times, also due to the brightened prospects of the sector.

The investment bank added that the enforcement of lockdowns and travel restrictions locally had caused deferments in orders by a couple of quarters rather than order cancellations in most of the companies with order pipelines remaining strong and intact.

Most Products to Grow in 2021

The World Semiconductor Trade Statistics (WSTS) released its updated forecast in December 2020, projecting a growth of 5.1% year-on-year (YoY) in 2020 to US$433 billion (RM1.74 trillion) mainly from the Americas and Asia Pacific regions.

Growth is expected in all major product categories except for optoelectronics and discrete semiconductors which are expected to see 2.6% and 1.2% declines respectively.

The largest growth contributors are memory integrated circuits (IC) (12%) and sensors (7%).

For 2021, WSTS projects an 8.4% growth across all geographical regions and product categories, with double-digit growth expected for memory ICs and optoelectronics.

“Overall, the Covid-19 impact on the sector is less severe than expected, leading the WSTS to raise forecasts for 2020 and 2021,” said the bank.

The Semiconductor Industry Association recorded US$39 billion sales in October 2020 (3% month-on-month, 6% YoY) showing the global semiconductor market’s resilience in light of Covid-19 and other macroeconomic factors with projections of moderate growth in 2020 and larger growth in 2021.

Sales rose 14%, 6% and 5% YoY in October 2020 in the Americas, China and Asia Pacific/All Other, but declined by 1% and 5% in Japan and Europe respectively.

Software and Hardware

Global IT spending is also expected to grow 4% in 2021 to US$3.8 trillion, with the strongest rebound expected from enterprise software (7% YoY) to support remote working, deliver virtual services such as distance learning and telehealth, and leverage hyper-automation to meet pandemic-driven demands.

Data centres will experience the second highest growth (5% YoY) due to increased dependence on cloud services from businesses.

ViTrox is expecting a strong demand in its automated board inspection segment, especially for servers and data centres due to increased work-from-home requirements.

In the first nine months of its financial year of 2020 (9MFY20), computing accounted for 31% of ViTrox’s revenue. This was echoed by MPI which saw higher demand for its copper clip products related to the server market which contributed to industrial revenue, accounting for 27% of its top line.

Personal computer and notebook sales also increased for MPI with a 12% contribution in the first quarter of financial year 2021 (1QFY21) (versus 9% in 1QFY20) as a result of increased remote work and distance learning requirements.

Pent-up Demand

In 3QCY20, global smartphone sales contracted 6% YoY to 366 million units as sales continued to be weak despite vendors introducing multiple 5G smartphone offerings and as lockdown measures eased likely due to consumers limiting discretionary spending and delays in 5G network upgrades due to the Covid-19 pandemic.

“Companies such as Globetronics benefitted from the pent-up demand. Globetronics’ 9MFY20 core profit of RM33 million (12% YoY) was underpinned by stronger volume loadings for its three key sensor products, ie light, gesture and motion sensors on the higher demand of smart devices,” AmInvestment noted.

The bank added that Inari Amertron’s radio frequency division’s higher revenue boosted the group to its highest-ever core profit of RM70 million in 1QFY21.

Global EV sales which reached 2.9 million in 2020 benefitted companies like MPI where it received higher demand for EV-related products from the US and European Union in 1QFY21.

The group has been investing in SiC and GaN technologies to focus on growing its power packaging segment with its customers.

AmInvestment may upgrade the sector to ‘Overweight’ if companies under its coverage secure significant jobs and/or major customers; US dollar outlook strengthens; adoption of technological trends such as 5G is faster than expected, high demand for end products is spurred; and the US-China trade relations improve, which will help to reduce market uncertainty.

“We may downgrade our stance on the sector to ‘Underweight’ if weak economic conditions are sustained by the delay in containing Covid-19 cases globally, demand for end products is weighed down; margin decreases in the face of a weakening US dollar; and trade war ties between the US and China worsen, specifically relating to technology and intellectual property,” it added.