Get instant alerts when news breaks on your stocks. Claim your 1-week free trial to StreetInsider Premium here.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

or

☐ TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 333-193087

FOCUS UNIVERSAL INC.

(Exact name of registrant as specified in

its charter)

| Nevada | 46-3355876 | |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) | |

| Incorporation or organization) | ||

| 2311 East Locus Street, Ontario, CA | 91761 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including

area code (626) 272-3883

Securities registered under Section 12(b)

of the Exchange Act:

| Title of each class |

Name of each exchange on which registered |

|

| Common Stock | ||

| $0.001 par value | None |

Securities registered under Section 12(g)

of the Exchange Act:

None

(Title of class)

Indicate by check mark if the registrant

is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes ☐ No ☒

Indicate by check mark if the registrant

is not required to file reports pursuant to Section 13 or 15(d) of the Act. ☐

Indicate by check mark whether the registrant

(1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to

submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of

delinquent filers in response to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best registrant’s knowledge, in definitive proxy or information statements incorporated by reference

in Part III of this Form 10-K or any amendments to this From 10-K. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☒ |

| (Do not check if a smaller reporting company) | Emerging growth company ☒ |

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared

or issued its audit report. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of March 22, 2021, the date

immediately preceding the filing of this Annual Report, the aggregate market value of voting stock held by non-affiliates of

the registrant, based on the closing price of the Over-The-Counter QB of $4.25 per share, at which the common equity was

sold, was $174,078,899.

The number of shares outstanding of the

registrant’s common stock, $0.001 par value, outstanding as of March 23, 2021: 40,959,741.

DOCUMENTS INCORPORATED BY REFERENCE

None.

FOCUS UNIVERSAL INC.

FORWARD LOOKING STATEMENTS

This Annual Report contains forward-looking

statements. Forward-looking statements are projections of events, revenues, income, future economic performance or management’s

plans and objectives for our future operations. In some cases, you can identify forward-looking statements by terminology such

as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”,

“estimates”, “predicts”, “potential” or “continue” or the negative of these terms

or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other

factors, including the risks in the section entitled “Risk Factors” and the risks set out below, any of which may cause

our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any

future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These

risks include, by way of example and not in limitation:

| · | the uncertainty of profitability based upon our history of losses; |

| · | risks related to failure to obtain adequate financing on a timely basis and on acceptable terms to continue as going concern; |

| · | risks related to our international operations and currency exchange fluctuations; and |

| · | other risks and uncertainties related to our business plan and business strategy. |

This list is not an exhaustive list of

the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully, and

readers should not place undue reliance on our forward-looking statements. Forward-looking statements are based on management’s

beliefs, estimates and opinions on the date the statements are made, and we undertake no obligation to update forward-looking statements

if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected

in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the

forward-looking statements to conform these statements to actual results.

Our financial statements are stated in

United States dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. All references

to “common stock” refer to the common shares in our capital stock.

As used in this annual report, the terms

“we”, “us”, “our”, the “Company” and “Focus Universal” mean Focus Universal

Inc. unless otherwise indicated.

Company Background.

Focus

Universal Inc. (the “Company,” “we,” “us,” or “our”) is a Nevada corporation. We

have developed four fundamental disruptive proprietary technologies which solve the most fundamental problems plaguing the internet

of things (“IoT”) industry through: (1) increasing overall chip integration by shifting it to the device level; (2)

creating a faster 5G cellular technology by using Ultra-narrowband technology; (3) leveraging ultra-narrowband power line communication

(“PLC”) technology; and (4) User Interface Machine auto generation technology.

A new IC frontier:

increasing IC integration directly at the device level

| 1. | We push beyond the current integrated chip limits with our device on a chip technology – which increases the overall degree of chip integration by shifting integration from the component level directly to the device level |

We

have developed an innovative and proprietary “device on a chip” (“DoC”) technology, which combines the

required electronic circuits of various integrated circuit components onto a single, integrated chip (“IC”). Our DoC

technology works as a single component but is capable of handling entire IoT device functions. Our DoC technology includes both

the hardware and software, uses less power, has better performance, includes smaller overall devices,

and offers greater reliability in spite of decreasing the number of interconnections between components.

We believe that implementing our DoC technology will allow our products to have a faster time-to-market than our competitors,

lower the cost, and simplify production than our competitors’ multi-chip devices. Our

DoC technology allows devices to achieve interoperability with one another and interchangeability which traditional IoT devices

are unable to achieve.

Our research and

development identified that the current IC integration in IoT devices focuses on pure hardware-to-hardware integration. The lack

of incorporating software such as a common operating system, application software and extra

interface into ICs limits IC integration only to the component level. Software is

a critical component in electronics, and the more tightly integrated the software, the better the power and performance. Software

also adds an element of flexibility and allows multiple discrete ICs which in the past were unable to be further integrated into

a single IC.

Unfortunately,

only customized hardware and software are currently available, and customized hardware and software integration leads to a custom

IC fabrication which is too expensive to manufacture on a large scale. IC is ideally designed

for products that are intended for mass production to keep manufacturing costs low by producing uniform products using repetitive

and standardized processes. Product standardization has become a major bottleneck in device-level IC fabrication because most devices

are custom-designed and manufactured.

The Universal Smart Instrumentation Platform

(“USIP”) we developed is a standardized, universal hardware and software integration platform, that provides a universal

common foundation for what we anticipate will be thousands of IoT and standalone devices. Electronic design and production starts

from a 90% completed USIP instead of the components. USIP allows ICs to be integrated from the component level up to the device

level and pushes the frontier of semiconductor technology beyond Moore’s law allowing the principle of Moore’s Law

to continue.

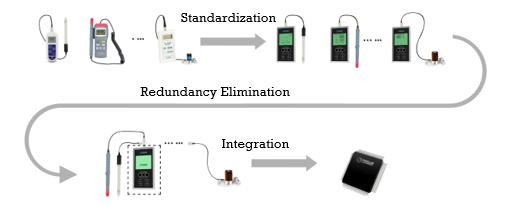

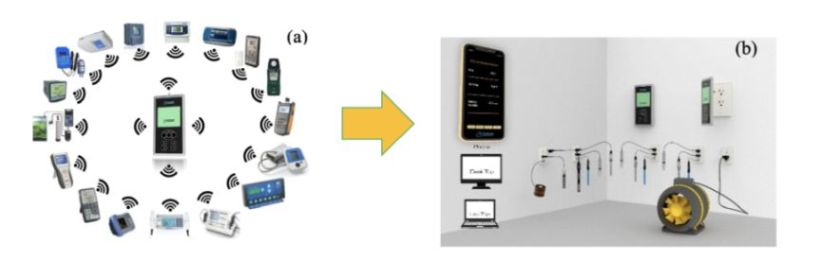

Figure 1. From USIP to device

level integrated circuits.

| 2. | Our Ultra-narrowband (“UNB”) technology breaks through the Shannon Law’s critical limit which current 5G cellar communication is reaching |

Fifth generation (“5G”) telecommunications

networks will revolutionize the digital economy by enabling new applications that depend on ultra-fast communications on an industrial

scale. 5G promises to deliver an improved end-user experience by offering new applications and services through gigabit speeds,

and significantly improved performance and reliability. 5G will build on the successes of 2G, 3G and 4G mobile networks, which

have transformed society, supporting new services and new business models. 5G provides an opportunity for wireless operators to

move beyond providing connectivity services, to developing rich solutions and services for consumers and industry across a wide

range of sectors at an affordable cost. 5G is an opportunity to implement wired and wireless converged networks and offers in particular

opportunities in integrating network management systems. The United States and China are in a race to deploy 5G, wireless networks,

and the country that gets there first will lead in standard-setting, patents, and the global supply chain. A recent World Economic

Forum report concluded that 5G networks will contribute $13.2 trillion in economic value globally and generate 22.3 million jobs

from direct network investments and residual services.1 5G networks and their related applications are expected to add

three million jobs and $1.2 trillion to the economy in the U.S.2 Though 5G offers a significant increase in speed and

bandwidth, its more limited range will require further infrastructure. Higher frequencies enable highly directional radio waves,

meaning they can be targeted or aimed. The challenge is that 5G antennas, although able to handle more users and data, can only

beam out over shorter distances.

Unlike 4G LTE, which operates on established

frequency bands below 6GHz, 5G requires frequencies up to 300GHz. Wireless carriers still need to bid for the costly higher spectrum

bands, as they build and roll out their respective 5G networks. Adding the necessary hardware required for 5G networks can significantly

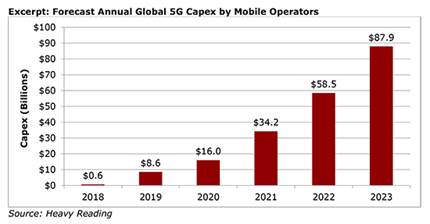

increase operating expenses. Building 5G networks is expensive. According to Heavy Reading’s Mobile Operator 5G Capex, total

global spending on 5G is set to reach $88 billion by 2023. 3

____________________________________

1 http://www3.weforum.org/docs/WEF_The_Impact_of_5G_Report.pdf

2 https://www.marketsandmarkets.com/Market-Reports/power-line-communication-plc-market-912.html

(last accessed on February 9, 2021)

3 Heavy Reading, Report, “Mobile

Operator 5G Capex Forecasts: 2018-2023” available at: http://www.heavyreading.com/details.asp?sku_id=3568&skuitem_itemid=1789

(last accessed on January 24, 2021).

Figure 2. Mobile

Operator 5G Capex Forecasts: 2018-2023.

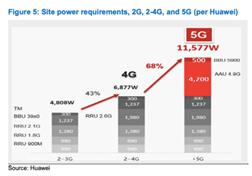

A

typical 5G base station consumes up to twice or more the power of a 4G base station. Energy costs can grow even more at higher

frequencies, due to a need for more antennas and a denser layer of small cells. Edge computing facilities needed to support local

processing and new internet of things (IoT) services will also add to overall network power usage.

Figure

3. Site Power requirements 2G, 2-4G and 5G.

Select

5G base stations in China are being powered off every day from 21:00 to next day 9:00 to reduce energy consumption and lower electricity

bills. 5G base stations are truly large consumers of energy such that electricity bills have become one of the biggest costs for

5G network operators.

Ultra-narrowband

Modulation was conceived in 1985 as a method to be used with’ frequency modulation (FM) Sub-Carriers’ (as opposed to

‘FM Supplementary Carriers’, or ‘In Band On Channel’ Carriers). In its original form, data rates as high

as 196 kb/s were obtained from a subcarrier at 98 kHz. A pulse width modulation baseband encoding method called the “Slip

Code” was used. That method, which was basically a baseband method, was limited in data rate and required excessive filtering,

which precluded it from being a practical Ultra-narrowband method. Bandwidth efficiencies as high as 15 bits/sec./Hz were being

achieved, Dr. Harold R. Walker is the ultra-narrowband pioneer.

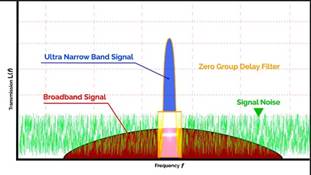

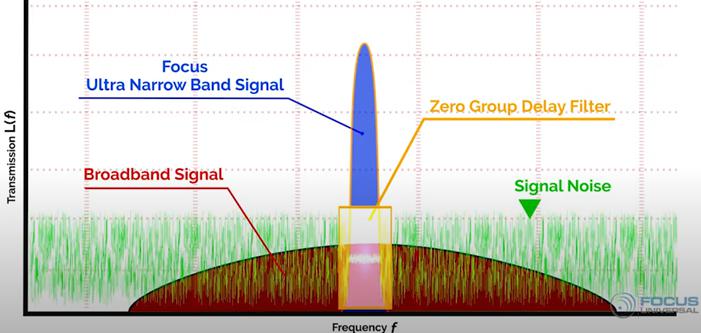

Ultra-narrowband (“UNB”) technology

employs an ultra-narrow spectrum channel (<1KHz) to establish an ultra-long-distance link between transmitter and receiver.

It allows the long-range coverage which makes it a most suitable low-power wide-area network technique for industrial IoT systems.

Additionally, its ultra-high power spectral density creates endurance against interference and jamming, which enables friendly

coexistence of UNB on shared frequency bands. The narrower the bandwidth, the fewer noise and interference, in addition, the transmission

energy concentrates on ultra-narrowband width, and results in a very high concentration of power in a very narrow frequency band.

Figure 4. Comparison between

Ultra-narrowband and Broadband

Many traditional modulation approaches

require allowance for upper and lower sidebands throughout the carrier frequency. UNB modulation is a modified approach for data

transmission without sidebands. UNB is extremely robust in an environment with other signals,

including spread spectrum signals. However, spread spectrum networks are affected by UNB signals.

UNB

modulation utilizes a coded baseband with abrupt edges. Any bandpass filter used at the transmitter for ultra-narrowband modulation

must exhibit zero group delay to pass the instantaneous phase changes, though it may lack the bandwidth required to pass instantaneous

changes in frequency. Conventional filters cannot be used with Ultra-Narrowband signals, which are absolutely dependent upon Negative

or Zero group delay filters.

There is one important characteristic which

is holding up widespread adoption of Ultra-Narrowband modulation, and that is the zero group delay filters which are complex and

must be hand tuned.

We developed an ultra-narrowband technology

which offers a potential alternative to broadband technology used in 5G and meets the challenging 5G demands. A comparison with

4G and 5G is given:

| Technology | Bandwidth | No. of subcarriers | Operating Frequency | Speed | Spectral |

| MHz | GHz | Mbps | Bits/s/Hz | ||

| 4G | 20 | 1200 | 6 | 4-60 | 6 |

| 5G | 100 | 3276 | Up to 300 | 40-1100 | 10 |

| UNB (finished) | 0.001 | 1 | 0.004 | 4 | ~4000 |

| UNB (in development) | 0.001 | 1 | 0.064 | 64-256 | >4000 |

UNB speed will increase proportionally

if it operates at higher frequency like 4G or 5G did, or adopts multiple subcarriers, which is equivalent to increasing bandwidth.

Utilizing the same bandwidth, UNB can saved energy up to 20,000 times for 4G and 100,000 times for 5G. Keeping the same bandwidth

and energy consumption, the coverage can increase two orders of magnitude. UNB Breaks through the Shannon Law’s critical

limit which current 5G cellar communication is reaching, overcomes the current 5G challenges and allowing cellar communication

development beyond 5G.

| 3. | We believe our Ultra-narrowband Power Line Communication (“PLC”), will revolutionize the fundamental IoT communication infrastructure |

Our

patented PLC is an innovative communication technology that enables sending data over existing power cables. It does not require

substantial new investment for a dedicated wiring infrastructure. Instead, PLC uses the existing power lines. These power lines

form a distribution network that already penetrates into every residential, commercial and industrial premises. Given that

the power grid is an established ubiquitous network, connectivity via PLC is potentially the most cost-effective, scalable interconnectivity

approach and the backbone communication infrastructure for the IoT. IoT

devices plug into power outlets and establish a connection using the existing electrical wiring. This allows instruments to share

data without the inconvenience of running dedicated network cables.

The

primary design goal of the power line network is electric power distribution. It was not originally designed as a communication

channel. Consequently, while PLC has been around for many years, the harsh electrical noise present on power lines and variations

in equipment and standards make communications over the power grid difficult and present a number of fundamental challenges for

data transfer. Signals propagating along the power line are subjected to very large amounts of noise, attenuation, and distortion

that make them erratic, with several attributes varying over time. PLC is susceptible to noise from devices linked to the power

supply infrastructure, for example, fluorescent tube lights, drills, hair dryers, microwave ovens, computers, switch mode power

supply, cellphone chargers, dimmers, refrigerators, televisions, washing machines, and vacuum cleaners. The

result being that previous implementations of PLC technology appear to have ended in power companies and internet service providers

deciding that the technology is not viable as a means of delivering broadband internet access. The technological challenges have

impeded, or even halted progress.

We have successfully developed ultra-narrowband

PLC technology and achieved 4 Mbps at bandwidth less than 1000 Hz. In our interference testing, six industrial blowers were used

and no significant interference was found. By comparison, a simple air dryer will render our competitors’ legacy technology

completely useless. Our 4Mbps PLC modules have been completed, and printed circuit layouts have been sent for production. These

modules will be used for IoT systems involving over 1,000 sensors. The higher communication speed PLC will be developed concurrently.

Ultra-narrowband

PLC is a considerably more effective tool than current in-home network systems. Zigbee or Z-Wave will need new infrastructure to

be installed. Moreover, penetrating physical barriers like walls within one floor, or reaching out to different floors is a challenge

for current wireless technology that current IoT systems are using. Wireless networks often face performance issues, due to radio-frequency

interference caused by devices like microwave ovens, cordless telephones or even Bluetooth devices at home. However, our PLC can

reach out to every node connected via the power lines. Our technology converts virtually every standard wall socket into an access

point, in many ways incorporating the best of wired and wireless communication.

| 4. | User Interface Machine auto generation technology – hardware defining software |

We

have developed a proprietary and patented “user interface machine auto generation platform” (“UIMAGP”),

this cross-platform or multiple-platform, cross-operating-system platform is designated to simply the software development of 20

billion IoT devices, ranging from hardware embedded coding to user interface design. Our universal natural programming language

we developed is the programming language used to build the IoT user interface. The programming language is similar to the language

humans use amongst one another so that it is easy to learn but understood by a machine. Future software programming is

expected to be enormously simplified to the maximum extent, with hundreds of thousands of lines of code simplified into a micro

code which can be saved in the sensor module. When the sensor modules are plugged into the USIP, the user interface code

saved at sensor modules are sent to the platform and a universal display such as a smartphone, a computer or display unit. The

UIMAGP saved on the universal display automatically generates the user interface within milliseconds instead of requiring months

or years of software development work. An embedded coding hardware engineer is able to design both sensor module hardware and provide

the user interface micro code. Thus, the hardware defining software is achieved.

UIMAGP is similar

in spirit to low code or no code programming in reducing the amount of traditional hand coding, enabling accelerated delivery of

business applications. However, low code and no code programming suffer from integration restriction, absence of customization

and security risks issues, making them not suitable for large-scale and mission-critical enterprise applications such as IoT applications.

UIMAGP overcome these challenges and still preserve a minimum amount of coding. The UIMAGP and user interface micro codes

work collectively to perform the function of the tradition customized software, enabling UIMAGP to be shared by the entire 20 billion

IoT devices.4

| 5. | Universal Smart Instrumentation Platform (“USIP”) |

Instrumentation

is a huge industry which covers variety of fields including medical, healthcare, scientific, commercial, industrial, military and

daily life. Lack of the instrumentation interoperability, compatibility and universality result in every instrument design starting

from the scratch or components, each instrument is only able to carry out a determined measurement or control a specific operation.

Integration of existing instruments which lack interoperability and compatibility into a platform can be difficult and expensive.

This integration is impeded by the inability of instruments to easily communicate with devices and sensors for perception, mobility,

and manipulation. As society enters the IoT era, it is not unreasonable to assume that millions of devices will need to be connected

in one square kilometer, if each IoT device requires unique hardware and software developed from scratch, implementation in dense

urban areas is simply not feasible.

USIP represents an advanced software and

hardware integrated instrumentation platform and a large-scale modular design approach. USIP integrates a large number of technologies,

including cloud technology, wired and wireless communication technology, software programming, instrumentation technology, artificial

intelligence, PLC, sensor network and internet of things into a single platform and results in circuit designs that are orders

of magnitude cheaper and faster than those constructed of discrete integrated circuit components from scratch.

USIP not only has primary functionalities

but also an open architecture of incorporating variety of many individual instruments,

functions, sensors and probes from different industries and vendors to the greatest extent

possible into the same single unit as well. Instruments, sensors or probes from a few to several hundreds or even thousands

in any combination from variety of industries and vendors share or reuse the same platform. Adding, removing or changing, instruments

or sensors is all the platform requires to switch from one kind of device to another without revising the software and redesigning

the hardware. Future instrument integration, design and manufacture are enormously simplified

to the maximum extent, only the sensor modules are required to be replaced, designed and manufactured.

Compared

to traditional stand-alone instruments, USIP exploits the processing power, productivity, display, and connectivity capabilities

of computers or mobile devices and provide a more powerful, flexible, and cost-effective measurement solution. Traditional

hardware-centered instrumentation systems are made up of multiple stand-alone instruments

that are interconnected to carry out a determined measurement or control an operation. They have fixed vendor-defined functionality

and their components that comprise the instruments are also fixed and permanently associated with each other. Different instruments

provided by different vendors cannot be interoperated and interchanged. For example, we simply cannot use a traditional blood pressure

meter to measure temperature or vice versa. USIP is designated to be compatible with

all instruments, sensors or probes on the market and capable of monitoring and controlling any combination of instruments or sensors.

It has brought a revolution to the field of instrumentation, measurement, control and automation.

USIP is a versatile instrument, able to

do many different measurements and controls, substitutes for many other instruments and integrate existing instruments into it.

The promise of USIP is closely associated with the development and proliferation of computers

and mobile equipment which provide the fundamental foundation and major technical support to the universal smart instrument such

as attractive graphical user touch screen interface, data processing and analysis capabilities, video and audio, cameras, GPS,

ubiquitous wireless connectivity, AI, cloud based communications and almost

unlimited functions or software available to the users that do not contain in the traditional

instruments. These features embody the advantages of USIP which are lacking in the stand-alone instrument system. As compared with

the traditional instrument, the best advantage of USIP is cost saving. Other distinctive

features include universality, interoperability, flexibility,

compatibility, upgradeability, expandability, scalability, security, modularity, fast prototyping, reducing inventory, plug-and-play

operation, remote accessibility, simplification, standardization, cloud instrumentation.

____________________________________

4 Gartner Insights “Leading

the IoT,” available at: https://www.gartner.com/imagesrv/books/iot/iotEbook_digital.pdf (last accessed February 9, 2021).

We have been dedicated to solving instrumentation

interoperability for over a decade. We subdivide instruments into a reusable foundation

component to the maximum extent and architecture-specific components, the sensor modules,

which together perform the functions of traditional instruments at a fraction of its cost.

USIP which presents to up 90% of the instruments, consists of universal and reusable hardware and software, these reusable hardware

and software are the same for all the instruments.

USIP utilizes a computer or a mobile device

as a display and control, communicates and works with a group of sensors, instruments, probes or controllers manufactured by different

vendors in a manner that requires the user to have little or no knowledge of their unique characteristics.

The

portable version of USIP is illustrated below, when a blood pressure sensor is plugged into universal device, the user interface

specification code saved on the blood sensor module is sent the universal device and a computer or smartphone which will generate

the user interfaces in the corresponding devices based on the interface specification code.

Figure

5. A blood pressure sensor is connected to our Universal Device we call the Ubiquitor and changes our device into a blood pressure

measurement instrument.

Similarly,

if we remove the blood pressure sensor and change to a pH sensor and a CO2 sensor, the universal device changes to a two-sensor

device which is capable of measuring pH and CO2 concentration. Each sensor has its own user interface which is auto generated based

on the user interface code saved in each sensor.

Figure

6. A pH sensor and a CO2 sensor are connected to our universal device and our device changes into a split-sensor device. A computer

or smartphone can also be used for display.

Figure

7, A pH sensor, a CO2 sensor and a light sensor are connected to the universal device and change it to a 3-sensor device. A computer

or smartphone can also be used for display.

Figure

8, any number of sensors in any combination are connected to the universal device and change it to a multiple sensor device. A

computer or smartphone can also be used for the display.

The

universal platform we built as illustrated in Figure 8, can control 27 light sensors, 21 pH sensors, 23 temperature humidity sensors

which have 23 temperature sensors and 23 humidity sensors, representing one controller and a total of 72 devices and 95 sensors.

Our controller controls 2 lights, and it can turn the light on or off. The controller also uses a light sensor to control the light,

and the user can input the desired light intensity, running period and light output intensity.

Figure

9, Our universal platform simultaneously monitors and controls 72 distinct devices.

To

illustrate, the entire horticulture industry only has a few hundred devices from different vendors for various measurement and

control. One of our universal smart devices and corresponding sensors or actuators are capable of replacing all of them at a fraction

of the cost.

Figure

10. Traditional horticulture measurement and control devices.

Figure

11. Universal Smart Device.

All of the

household measurement and control devices such as air conditioner control, swimming pool control, garage door control, sprinkler

control, lighting control, motorized curtain control, etc. can be replaced by a single universal smart device and corresponding

unique accessories.

Figure 12. A single universal

smart device can replace all the household control devices.

| 6. | Shared Distributed Universal Internet of Things. |

IoT

refers to the overarching network created by billions of internet-compatible devices and machines which share data and information

around the world. According to a Gartner report, by the end of 2020, there were an estimated 20 billion IoT connected devices in

use around the world.5 As the sophistication of both hardware and software in the consumer electronics industry skyrockets,

an increasing share of the electronic devices produced around the world are manufactured with internet connectivity. Forecasts

suggest that by 2030 around 50 billion of these IoT devices will be in use around the world, creating a massive web of interconnected

devices spanning everything from smartphones to kitchen appliances.6 The IoT will have a great impact on the economy

by transforming many enterprises into digital businesses and facilitating new business models, improving efficiency and increasing

employee and customer engagement. It is foreseeable that the explosive IoT growth will rapidly deplete natural and human labor

resources. We believe that IoT will soon reach the critical limit, we do not have enough human labor and natural resources to support

IoT growth. 20 billion IoT devices are both challenges and resources. We have overcome the current massive IoT production challenges

through our development of a shared distributed universal IoT. Billions of internet-compatible devices and machines not only share

data and information around the world, but also share large section of hardware and software (up to 90%).

Billions of IoT devices are in use across

the country, each with different terminologies, technical specifications, and functional capabilities. These differences make it

difficult to create one standard interoperability format for acquiring, harmonizing, storing,

accessing, analyzing and sharing data in near real-time. In fact, not even those instruments built on the same platform

are necessarily interoperable because they are often highly customized to an organization’s unique workflow and preferences.

Wireless

networks are far from perfect for IoT. They are typically slower, expensive and extremely susceptible to interference from radio

signals and radiation. They can be accessed by any device within range of the network’s signal so information transmitted through

the network (including encrypted information) may be intercepted by unauthorized users. Walls and floors can seriously limit the

range of the wireless network. Our proprietary Ultra-Narrowband power line communication technology offers a promising alternative

to wireless networks. Integrating USIP with PLC results in significant simplification and cost saving in implement of IoT as illustrated

in Figure 13.

Figure

13. Comparison between traditional machine to machine IoT (a) and shared distributed universal IoT (b). USIP and sensors form a

local network through power line communication. The platform communicates with the cloud and forms a remote cloud-based system.

_____________________________________

5 Gartner Report “Leading the IoT: Gartner

Insights on How. To Lead in a Connected World” available at: https://www.gartner.com/imagesrv/books/iot/iotEbook_digital.pdf

(last accessed February 10, 2021).

6 Id.

Figure

14. (a) traditional wireless network and Focus Universal Inc’s PLC network.

How

we will implement our business plan

Once

we are fully capitalized, we will establish four divisions within our company to develop and promote our four fundamental technologies

even further. We believe that these four technologies not only can be used in standalone device design and production, but also

focus on massive scale IoT device design and production, aiming to solve the complexity and cost challenges.

a) Ultra-narrowband

power line communication division

Our ultra-narrowband PLC technology has

achieved data transfer speeds of 4 megabits per second (“Mbps”), with a bandwidth of less than 1000 hertz (Hz). These

results are 15 times faster than the Zigbee short-range wireless technology mesh networks and 100-400 times faster than Z-wave

low-energy wave short-range wireless technology. The current 4Mbps PLC modules will be used

for IoT applications involving thousands of sensors. We are developing even higher communication speeds through our PLC. The ultra-narrowband

PLC module will be integrated to IC. This division will focus on ultra-narrowband PLC research and development, promote and market

ultra-narrowband PLC ICs and finished products.

Given that the power grid is an already

established ubiquitous network spanning back hundreds of years, connectivity via PLC technology is potentially the most cost-effective

and scalable interconnectivity approach and, thus, the ideal backbone communication infrastructure for the IoT industry. However,

the harsh electrical noise and interference present on power lines and variations in equipment and standards make data transfer

using PLC technology difficult and limits the technology’s applications. Accordingly, the global market for PLC technology

is very limited.

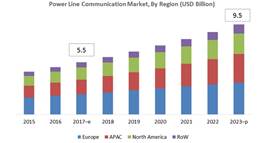

Figure 15. Markets and Markets

Updated date – Oct 25

The

market size is expected to reach $9.5 billion at the end of 2023.7 This prediction is based on current PLC technology,

which provides speeds that are too slow (usually less than 9,600 bps), coverage that is too short (200-300 yards) and harsh electrical

noise and interference. The major vendors of PLC technology include ABB, General Electric, Siemens, AMETEK, Texas Instruments,

Maxim Integrated, Devolo, Cypress Semiconductor, ST Microelectronics, Panasonic, Microchip, Qualcomm Atheros, TP-Link Technologies,

NETGEAR, NXP Semiconductor NV, Sigma Designs, Zyxel Communications and Renesas Electronics Corporation.

It

is our understanding that we are the only vendor currently working on ultra-narrowband PLC technology. With the introduction of

our ultra-narrowband PLC technology, which is able to overcome the interference challenges presented by traditional PLC technology,

we believe that market size will increase significantly. With the help of our ultra-narrowband technology, which is able

to overcome the noise challenge, we believe that the overall market size may increase significantly. Utilizing ultra-narrowband

PLC, the global IoT communication infrastructure cost and operating cost can be saved.

b) Ultra-narrowband

wireless division

This

division will focus on developing ultra-narrowband wireless technology and overcoming the challenges faced by current 5G networks,

thereby allowing cellular communication development to go beyond the 5G networks.

In

developing our ultra-narrowband PLC technology, we gained a lot of insight that is being used to develop a single carrier wave

ultra-narrow band wireless technology, which aims to increase data transfer rates from 4 Mbps to 64 Mbps. Ideally, our ultra-narrow

band wireless technology will be able to achieve data transfer rates of 256 Mbps, which is close 5G speeds, which require 3,276

subcarrier waves. The speed can be further increased if multiple carrier waves or higher operating frequencies are used.

Our

current research and development efforts only focus on an operating frequency of 64 megahertz (MHz), which is about 100 times lower

than 4G networks (6 gigahertz (GHz)) and 5,000 times lower than 5G networks (up to 300 GHz). Our technology’s 1,000 Hz bandwidth

is approximately 20,000 times narrower than 4G networks and 100,000 times narrower than 5G networks. The narrower the bandwidth,

the less energy consumption. By maintaining the 1,000 Hz band width, our ultra-narrowband wireless technology can save electricity

usage by a factor of up to 100,000 times when compared with a 5G networks. We believe that our ultra-narrowband wireless technology

has the potential to push the wireless frontier well beyond 5G. We expect to finalize our ultra-narrowband technology with data

transfer speeds of 64-256 Mbps during the first of second quarters of 2021.

5G

infrastructure market is projected by Markets and Markets to reach USD 47,775 million by 2027, at a CAGR of 67.1%. The major players

in the 5G infrastructure market are Huawei (China), Ericsson (Sweden), Samsung (South Korea), Nokia Networks (Finland), ZTE (China),

NEC (Japan), CISCO (US), CommScope (US), Comba Telecom Systems (Hong Kong), Alpha Networks (Taiwan), Siklu Communication (Israel),

and Mavenir (US). Huawei (China) is the leader in the 5G infrastructure market. Limited coverage, high energy consumption and expensive

infrastructure installation are the major bottleneck in 5G. All the 5G technologies are based on broadband technology, our research

suggests there are very few, if any company working on ultra-narrowband technology and have difficulty finding any literature after

2014. We believe that adopting our ultra-narrowband wireless technology, the 5G higher spectrum bands cost, 5G network hardware

cost and 5G energy consumption costs could be saved significantly.

c) User

interface machine auto generation division

Established

in 2009, our company’s software user interface machine auto generation technology division has developed 100 sensors in arbitrary

combinations, all of which have been tested for IOS system. RS-485 is the communication standard defining the electrical characteristics

of drivers and receivers for use in serial communications systems. The current RS-485 standard modules available on the market

do not support more than 100 sensors. The first version of UIMAGP has been completed and is ready for marketing.

UIMAGP

not only can

be used in IoT software design, but also can be applied to other industry sectors, this division is planning to expand to other

industry as well.

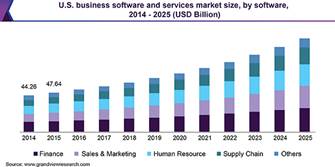

The software market size

is enormous. According to

www.grandviewresearch.com, the market reached $388.98 billion in 2020.

___________________________________

7 Market Research Report “Powerline

Communication Market by Offering (Hardware, Software, and Services), Frequency (Narrowband, and Broadband), Application (Energy

Management and Smart Grid, and Indoor Networking), Vertical, and Geography – Global Forecast to 2023,” available at:

https://www.marketsandmarkets.com/Market-Reports/power-line-communication-plc-market-912.html (last accessed February 10, 2021).

Figure

16. Software market size.

Some

of the biggest companies within the software industry today include Microsoft, IBM, Oracle, SAP and Salesforce, all boasting billion

dollar revenue figures. None of them has developed a UIMAGP. Any software which can be created by low code and no code programming

can also be created by using UIMAGP. However, the software created by UIMAGP achieves what low code and no code programming cannot

because of the complexities of applying the code to different platforms and the accompanying required customization. One of the

distinct features of UIMAGP is that the programming provides a starting point which includes foundational code that may be used

on any platform, operating system, etc. This makes the final programming much more efficient, as it only needs relatively few lines

of code to program a complicated application.

d)

Universal smart instrument division

This

division will focus on developing and marketing end user universal smart instruments and shared distributed universal IoT devices.

The development of universal smart instruments and IoT have a considerable amount of overlap, with the only difference being

the number of devices involved. We take this overlap a step further, unify universal smart instruments and IoT into a single system,

eliminating any distinction between them. Using USIP which is cost effective and fully production-ready hardware and software platform

have a huge advantage in shorting design, build, test and fix cycles. The design cycle improved from a few years to a few weeks.

The smart home products including light control, air conditioner control, sprinkler control, garden light control, heating floor

control, motorized curtain control, pool filtration and algae control, smoke detector control, carbon monoxide measurement, motion

detector, doorbell have been designed and tested. Industrial IoT devices design including industrial light control, temperature

control, humidity control, carbon dioxide control, digital lighting control, quantum PAR measurement and control, pH measurement

and control, TDS measurement and control, fan speed control has been completed. We anticipate that this division will market and

distribute these products during the second quarter of 2021; and start presale marketing during the first quarter of 2021.

The instrumentation industry is also very

large and difficult to estimate due to the high number of industry sectors. However, the IoT industry sector is only a fraction

of the larger market. MarketsandMarkets forecasts the global IoT market size is expected to reach $561 billion by 2022.8

The key market players include Intel Corporation (US), SAP SE (Walldorf, Germany), Cisco Systems, Inc. (US), Microsoft Corporation

(US), Oracle Corporation (US), International Business Machine (IBM) Corporation (US), PTC Inc. (US), Google Inc. (US), Hewlett-Packard

Enterprise (US), Amazon Web Services Inc. (US), Bosch Software Innovation GmbH (Stuttgart, Germany) and General Electric (US).

All of these industry players’ IoT devices are of a traditional machine to machine type and have fundamental challenges

in terms of their cost and implementation. Our shared distributed universal IoT devices are much more cost efficient.

This division will also focus on development

of device-on-a- chip ICs. We will distinguish our DoC technology from the component ICs, these ICs are able to perform entire device

functions. According to the “integrated Circuits Global Market Report 2020,” 9 the

global integrated circuits market was worth $412.3 billion in 2019. The market is expected to grow at a CAGR of 5.09% and reach

a value of $502.94 billion by 2023. Major players in the IC market are Intel Corporation, Texas Instruments, Analog Devices, STMicroelectronics,

NXP, ON Semiconductor, Micron, Toshiba, Broadcom and Qualcomm.

___________________________

8 Id.

9 The Business Research Company, March 2020, “Integrated

Circuits Global Market Report 2020,” available at: https://www.thebusinessresearchcompany.com/report/integrated-circuits-global-market-report

(last accessed January 24, 2021).

Products we are currently selling

We are also a wholesaler of various digital,

analog, and quantum light meters and filtration products, including fan speed adjusters, carbon filters and HEPA filtration systems.

We source these products from manufacturers in China and then sell them to a major U.S. distributor, Hydrofarm, who resells our

products directly to consumers through retail distribution channels and in some cases, places its own branding on our products.

Specifically, we sell the following

products:

Fan speed adjuster device. We provide

a fan speed adjuster device to our client Hydrofarm. Designed specifically for centrifugal fans with brushless motors, our adjuster

device helps ensure longer life by preventing damage to fan motors by adjusting the speed of centrifugal fans without causing the

motor to hum. These devices are rated for 350 watts max, have 120VAC voltage capacity and feature an internal, electronic auto-resetting

circuit breaker.

Our Fan Speed Adjuster Device

Carbon filter devices. We sell two

types of carbon filter devices to our client Hydrofarm. These carbon filter devices are professional grade filters specifically

designed and used to filter air in greenhouses that might be polluted by fermenting organics. One of these filters can be attached

to a centrifugal fan to scrub the air in a constant circle or can be attached to an exhaust line as a single pass filter, which

moves air out of the growing area and filters unwanted odors and removes pollens, dust, and other debris in the air. The other

filter is designed to be used with fans from 0-6000 C.F.M.

Our Carbon Filter Device

HEPA filtration device. We provide

a high-efficiency particulate arrestance (“HEPA”) filtration device at wholesale prices to our client Hydrofarm. Manufactured,

tested, certified, and labeled in accordance with current HEPA filter standards, this device is targeted towards greenhouses and

grow rooms and designed to keep insects, bacteria, and mold out of grow rooms. We sell these devices in various sizes.

Our HEPA Filtration Device

Digital light meter. We provide

a handheld digital light meter that is used to measure luminance in fc units, or foot-candles.

Our Digital Light Meter Device

Quantum par meter. We provide a

handheld quantum par meter used to measure photosynthetically active radiation (“PAR”). This fully portable handheld

PAR meter is designed to measure PAR flux in wavelengths ranging from 400 to 700 nm. It is designed to measure up to 10,000 µmol.

Our Quantum Par Meter Device

Strategy behind the AVX Acquisition

On March 15, 2019, the Company completed

a transaction with Patrick Calderone to purchase 100% of the outstanding stock of AVX, an IoT installation and management company

based in southern California.

Through our acquisition of AVX, we are

planning to offer ordinary families an entire smart home product line at a fraction of the current market price. We have finished

the design of smart lighting control, air conditioner, sprinkler, garden light control, garage door control and heating control.

We are developing a swimming pool control device, smoke detector and carbon monoxide monitor. We believe these product lines could

be completed by the end of 2021.

It

is our intention to offer a complete line of smart home products, designed by Focus Universal, and marketed and installed by AVX,

in the $3,000 range. Where a family would likely choose not to install a $300,000 system in a $150,000 home, even if they could

afford to do so, the same family would be more inclined to install a smart home product at the $3,000 price point. We believe smart

home installation based on the Ubiquitor will include more functionalities than the current systems offered by our competitors.

Our smart home systems would be able to integrate, exchange data, interact and connect utilizing our PLC technology. As a result,

the installation process would be simplified, and its costs would be dramatically reduced.

Once

successfully integrated, the Ubiquitor will be central to every smart home installation that AVX does. The Ubiquitor’s connectivity

capabilities will allow for that system to be expanded and customized in the future.

We

intend to complete the design for the first hardware products, specifically, a surveillance camera and a doorbell, by the end of

2021 and believe we can begin to start installing these new shared distributed smart home products in the next few years. We plan

to offer a zero down payment option for the installation of AVX’s smart home systems and charge a monthly subscription fee

instead.

Notwithstanding

the foregoing, should we be unable to successfully integrate the Ubiquitor into AVX’s smart home installations, the Ubiquitor

will continue to be a flagship product of our Company that can be applied to a variety of other purposes in the different industries

and fields mentioned above.

We currently operate in the scientific

instruments industry and the smart home installations industry and plan to apply several of our new technologies to the IoT marketplace.

Index

of Key Technical Abbreviated Terms

| Abbreviation | Full Term |

| 5G | Fifth Generation Mobile Wireless Telecommunications Network |

| FSK | Gaussian Frequency Shift Keying |

| HANs | Home Area Networks |

| IC | Integrated Chip |

| IoT | Internet of Things |

| LTE Networks |

Long-Term Evolution Networks |

| MOS Transistor |

Metal-Oxide-Silicon Transistor |

| PLC | Power Line Communication |

| UNB | Ultra-narrowband |

| USIO | Universal Smart Instrumentation Operating System |

| USIP | Universal Smart Instrumentation Platform |

Growth Strategy

Strategy and Marketing Plan

The Company plans to market the USIP to

the industrial sector first, including key growth industries such as indoor agriculture. Once the technology is established there,

the core technologies of universality and interoperability through a readily available device, such as a mobile device or smartphone,

may be ported to products specifically intended for the consumer and residential markets.

While industrial markets are large, the

consumer and residential markets are even larger. This two-phase approach will allow for continuous and increasing revenue growth.

Moreover, during the industrial phase of development, the Company will be able to test and refine its products to ensure that they

are ready for the consumer and residential markets.

Once we have successfully entered the industrial

sector, we intend to roll out additional technologies that are currently under development. These technologies will both advance

and support the core technologies marketed in phases one and two to the industrial and consumer markets.

We will continue to design, manufacture,

market and distribute our electronic measurement devices, such as temperature humidity meters, digital meters, quantum PAR meters,

pH meters, TDS meters, and CO2 monitors. Over the years we have developed a broad and loyal customer base. The universal smart

technology has been applied to our existing traditional devices and demonstrated significant functionality improvement and hardware

cost savings. We believe hardware cost reductions of up to 90% have been achieved. However, promoting universal smart technology

and universal smart IoT devices to our customers, including traditional instrument manufacturers, will be the major focus of our

business in the future.

Different markets require different strategies.

We divided our customers into a few segments to determine what specific marketing technique will reach each targeted group and

its needs.

a) Our Existing Customer, Hydrofarm

To minimize the upfront cost of entering

a market, we must choose our entry point carefully so as to find one that offers the least possible resistance. It costs more to

attract new customers than to retain and increase sales to our existing customer, Hydrofarm. The design, development and manufacture

of our universal smart instruments is targeted to increase current sales to our existing customer.

Our current customer, Hydrofarm, is the

largest distributor in the horticulture industry with roughly 50% of the market share in the U.S. horticulture industry.

All our current universal smart devices,

including sensors and controllers, will be distributed to Hydrofarm. Smartphones can be used for display and control of all the

sensors and controllers in the horticulture industry. By the end of 2020, we completed the development all of the necessary sensors

used in the gardening industry, including a light control node, temperature sensor, humidity

sensor, digital light sensor, quantum PAR sensor, pH sensor, TDS sensor and carbon dioxide sensor; and we finished all the circuit

layouts for the pilot IoT system for the gardening industry (consisting of approximately 1,000 sensor nodes and controllers).

We sent these circuit layouts to our manufacturer in China for production. However, due to the coronavirus pandemic, the production

was delayed. By the third quarter of 2021 , we intend to market

our Ubiquitor device to Hydrofarm, who in turn will resell and market the device to its customers in the horticulture industry.

b) Online Customers

We intend to use traditional and specialized

e-commerce outlets to help with online brand awareness. By analyzing Amazon’s data, we plan to determine which traditional

instruments have the highest selling volumes and at what price point. Future research and development will focus on integrating

the sensors used in these instruments into the universal smart instruments to leverage on their existing markets.

c) Traditional Controller and Remote-Control

Customers

Traditional controllers monitor and control

their sensors through bi-directional communication implemented by hardware. The sensors or probes in controllers not only measure

the physical environment but also give feedback to the input actuators that can make necessary corrections. They are expensive

and require a corresponding monitor in which unidirectional communication is needed. For example, a traditional temperature meter

may cost approximately $15 and a temperature controller may cost approximately $100. The wireless bi-directional communication

supported by a smartphone or mobile device offers cost reduction in controller design and manufacturing. Traditional remote control

is accomplished through hardware, which can be replaced by a smartphone. Universal smart technology will also play an important

role in traditional control applications. Traditional controller users are one of highest profit margin customers of universal

smart technology.

d) Special Customers

For customers who consider an instrument’s

compatibility, interoperability, interchangeability, universality, upgradeability, expandability, scalability, and remote access

ability as crucial, universal smart technology has several fundamental advantages over traditional instruments in terms of hardware

cost and functionality. End users will not only enjoy the remote access to their sensors wirelessly but also save the cost of the

hardware module which will be replaced by a smartphone.

e) Traditional Instruments Manufacturers

We may consider selling the Ubiquitor directly

to instrument manufacturers and allowing them to distribute it through their established platforms.

We are putting together an internal sales

team in order to establish the marketing campaign for our sensor devices, including the Ubiquitor. We are also expanding the sales

team for AVX because we believe that the Ubiquitor device will be integral to smart home installations.

We believe that universal smart technology

will play a critical role for traditional industrial instrument manufacturers, because it is too expensive and difficult to develop

industrial instrument sensors for medium or smaller companies or individual homes. The cost factor is the first consideration when

deciding whether a company wants to develop universal smart technologies and implement them in their products.

Our goals over the next three years include:

| · | Raise capital to move into full manufacturing and production for our Ubiquitor device; |

| · | Partner with manufacturers and promote the adoption of our Ubiquitor device in a USIP; |

| · | Acquire a stable market share of the sensor device market; |

| · | Continue performing research and development on PLC technology; |

| · | Focus on building our smart home offerings so that we can reduce the cost of smart home implementation to focus on expanding smart home installation and implementation beyond luxury homes; |

| · | File additional patents to expand our intellectual property portfolio related to the many uses of our Ubiquitor device; and |

| · | File patents to protect our PLC technology. |

In order to achieve these goals, we intend to focus on the following

initiatives:

| · | Position the Ubiquitor device as the industry standard in universal sensor reading technology; |

| · | Establish strategic supply chain channels to facilitate efficient production operations; and |

| · | Communicate the product and service differentiation through direct networking and effective marketing. |

Growth Strategy

Growth through Mergers and Acquisitions

Mergers and acquisitions (“M&A”)

represent a significant part of our growth strategy because M&A can fill business gaps or add key business operations without

requiring us to wait years for marketing and sales cycles to materialize. We have used this growth strategy in our acquisition

of AVX, and in the future intend to continue to use M&A to find and secure opportunities that will either: (i) achieve the

objective of growth in our market segments; or (ii) provide an area of expansion that will add to the Company’s products

and/or service lines in markets that we are currently not serving but could serve if we had the appropriate expertise. The resulting

combination of our existing products and services, new key personnel, and strategic partnerships through M&A will allow us

to operate in new markets and provide new offerings to our existing market.

Acquiring key competitors may allow the

addition of key personnel to our team. These additions may include people with vast industry knowledge, which can act as a catalyst

to further our growth and lead to the development of new products and business lines. We will seek to target synergistic acquisitions

in the same industry, targeting different geographic locations, which will allow us to actively compete on a regional or national

scale in the IoT segment. If we target businesses in the same sector or location we hope

to combine resources to reduce costs, eliminate duplicate facilities or departments and increase revenue. We believe this strategy

will allow for accelerated growth and maximize investor returns.

One of our key strategies to grow by acquisition

is to acquire smaller businesses that focus on IoT installation technology (industrial or residential) and in the USIP or PLC industries.

Original

Equipment Manufacturer (“OEM”) Engineering Consulting and Design Services

Universal

smart technology is new to most electronic engineers and manufacturers. One way to promote our universal smart technology is to

provide direct OEM engineering design consulting services to potential industrial customers. Direct, on-site consulting will educate

our industrial consumers on the many ways our technology can be implemented in a variety of industrial applications. We believe

that we are well positioned to perform product design and perform engineering consulting services for future OEM customers.

We believe we can operate as a seamless extension of our customers’ engineering organizations and add scale, flexibility

and speed to their design processes. We will not be able to offer such engineering consulting and design consulting services until

the Ubiquitor is being produced and distributed. We believe that once the Ubiquitor is being produced and distributed, we will

have hired and trained enough engineers to execute our consulting strategy. Due to the timeline for the roll out of the Ubiquitor,

we believe that the earliest we would feasibly be able to implement such consulting services would be the fourth quarter of 2021.

Through our engineering consulting services strategy, we intend to become our customers’ engineering partner at all stages

of the design cycle so that we may effectively assist them in transforming ideas into production-ready products and accelerate

time to market for our universal smart technology product segment.

Technology Licensing

We

may also consider entering into licensing arrangements with our customers for our technology. We believe that once we educate our

industrial consumers, they may want to integrate our universal smart technology into their own technology through licensing agreements.

We believe licensing our intellectual property may provide a revenue stream with no additional overhead, all while allowing us

to retain proprietary ownership and creating long-term industrial consumers who rely on our products. By creating incentives, such

as cost incentives, to license our IP rather than design their own technology, we believe potential customers could save on design

costs and create business development opportunities. Licensing may also allow us to rely on the expertise, capacity and skill of

a licensee to commercialize our IP, which is especially valuable if we lack the infrastructure, financial resources and know-how

to bring a product to market independently. We believe that licensing will not occur until the last quarter of 2021 due to the

fact that we will need to have a team of our consulting engineers in place once we complete the offering and working with industrial

consumers on product integration, as well as time to negotiate the terms of licensing agreements with potential customers.

Distribution Method

We intend to engage in relationships predominantly

with standard U.S. component manufacturers and similar electronics providers for the manufacturing of unassembled parts of the

Ubiquitor and its sensor nodes, to then ship such parts to our Ontario, California facility where we will assemble the Ubiquitor

devices and sensor nodes. Afterwards, we would distribute our Ubiquitor devices to distributors and retailers directly and also

ship directly to traditional industrial instrument manufacturers. We have a sales department operating out of our Ontario, California

office and eventually plan to open a second sales department in China dedicated to promoting our technologies to local instrument

manufacturers who can utilize our Ubiquitor devices in their manufacturing and other processes. We intend to market the Ubiquitor

to industrial end-users through Hydrofarm, through direct business-to-business sales channels and also directly to consumers via

e-commerce internet platforms. For our quantum light meters, and air filtration products, we rely solely on Hydrofarm to distribute

to end-users through its distribution channels.

Raw Materials

The electronic components used in the Ubiquitor

are common and can be easily purchased through a variety of suppliers with little advance notice. We predominantly use large-scale

manufacturers in the United States such as Texas Instruments and Intel for the major components. Other key suppliers we could consider

include Analog Devices, Skyworks Solutions, Infineon, STMicroelectronics, NXP Semiconductors, Maxim Integrated, On Semiconductor,

and Microchip Technology. Production and assembly lines are also available worldwide if we needed to outsource or increase our

capacity, though we intend to complete our assembly in our Ontario, California facility. On October 1, 2018, we entered into an

agreement with Beijing Hengnar Technology Development Co., Ltd. to develop certain infrared online gas analyzer products that detect

O2, CO, CO2, H2, Nox, SF6 and other gases for our digital light meter and filtration business segment.

Manufacturing and Assembly

We have an assembly facility in Ontario,

California where we assemble the Ubiquitor from parts sourced predominantly in the United States. Our quantum light meters and

handheld sensors are also manufactured in our Ontario, California facility. Our air filtration products are manufactured and assembled

in China by a third-party contract manufacturer, Tianjin Guanglee.

Competitors

Sensor Node Industry

There are several competitors we have identified

in the sensor node industry, including traditional instruments or devices manufacturers such as Hanna Instruments or Extech Instruments.

Hach developed and launched the SC1000

Multi-parameter Universal Controller, a probe module for connecting up to 32 digital sensors or analyzers. However, their products

are not compatible with smart phones yet; and we believe their price point is still prohibitive to consumers.

Monnit Corporation offers a range of wireless

and remote sensors. Many of Monnit’s products are web-based wireless sensors that usually are not portable because of their

power consumption. Also, the sensors’ real-time updates are slow; and we believe security of the web-based sensor data acquisition

may be a concern. In addition to purchasing the device, consumers usually have to pay a monthly fee for using web-based services.

IoT Installation Industry

There are several companies that compete

with AVX in smart home installations, including Vivint Smart Home, Crestron and

Control4. However, we believe we can distinguish ourselves from our competitors by offering a substantially lower price. An installation

by Crestron ranges between $100,000 and $500,000 and by Control4 between $20,000 and $40,000. The cheapest competitor we can identify

in this sector is Vivint Smart Home, which costs less than $5,000 to install; however, we understand that the Vivint Smart Home

focuses on security systems only and that users have no other smart applications, which our smart home product line would include.

Air Filtration Systems and Meter

Products Industry

The air filtration system and meter products

industry is a niche industry. The global industrial air filtration market was valued at $11.6 billion in 2018 and analysts expect

it to register a CAGR of 6.7% from 2019 to 2025 because of the industrial need to control air quality across a range of industries.10

Air purification methods are an effective way to control contaminants and improve indoor air quality and as a result, many

national and local governments overseeing indoor air quality and other emissions are enacting stricter workforce health and safety

regulations in this area, which drives demand. One of our competitors, Donaldson Company, Inc., an air filtration company, announced

in its SEC filings that on October 18, 2018 it acquired BOFA International LTD (“BOFA”), headquartered in the United

Kingdom, for $98.2 million less cash acquired of $2.2 million. BOFA manufactures systems across a wide range of air filtration

applications.

We are not trying to compete with traditional

instruments or device manufacturers because we plan to utilize our Ubiquitor device in conjunction with our smartphone application.

We believe the resulting product may compete in a much wider product category due to its many potential applications.

Our Corporate History

The Company entered the residential and

commercial automation installation service industry through the acquisition of AVX Design and Integration, Inc. (“AVX”)

in March of 2019. AVX was established in 2000 with the goal of installing high-performance, easy-to-use Audio/Video, Home Theater,

Lighting Control, Automation and Integration systems for high-net-worth residential projects.

Additionally, we are performing research

and development on an electric power line communication technology and have filed three patents with the USPTO related to our Ubiquitor

device and the design of a quantum PAR photo sensor. Eventually, we hope that PLC will further enhance smart IoT installations

performed by AVX and powered by the Ubiquitor.

We are based in the City of Ontario, California,

and were incorporated in Nevada in 2012. In December of 2013, we filed an S-1 registration statement that went effective on March

14, 2014. Since then, our securities have been trading on the OTCQB Market.

Our website is www.focusuniversal.com.

Our website and the information contained therein or connected thereto are not intended to be incorporated into this prospectus.

On October 21, 2015, Dr. Jennifer Gu and

Dr. Edward Lee were appointed as directors of the Company. After such appointments, the Board of Directors consisted of Dr. Desheng

Wang, Dr. Jennifer Gu and Dr. Edward Lee.

On April 2, 2018, Duncan Lee was appointed

as the Chief Financial Officer of the Company.

On June 8, 2018, we announced the appointment

of four new board members of the Company, the majority of whom were independent: Sheri Lofgren, Sean Warren, Michael Pope, and

Carine Clark. Our Board of Directors formed our Audit, Compensation, and Nominating Committees.

_______________________________

10 Grand View Research. (2020, February). Industrial

Air Filtration Market Size, Share & Trends Analysis Report, by Product, by End Use (Cement, Food, Metals, Power, Pharmaceutical,

Agriculture, Paper & Pulp and Woodworking, Plastic), by Regionk and Segment Forecasts, 2020-2027. Retrieved at: https://www.grandviewresearch.com/industry-analysis/industrial-air-filtration-market.

On July 26, 2018, our Board of Directors

approved our submission of an application in compliance with the NASDAQ rules and regulations to list and trade our Company’s

securities on the NASDAQ Capital Market. As of the date of this prospectus, our application is pending NASDAQ’s approval

and our Company’s securities are not listed on the NASDAQ Capital Market.

On November 28, 2018, Sean Warren resigned

as a member of the Board of Directors; and Greg Butterfield was appointed in his place. On December 1, 2018, Mr. Warren became

a part-time consultant to the Company.

In late 2018, we purchased a manufacturing

warehouse and office space addressed at 2311 E. Locust Court, Ontario, CA, 91761. The property consists of an industrial type,

two-story building, with a total building area of 30,740 square feet. Ten thousand square feet will be utilized for office space;

and 20,000 square feet will be utilized for warehouse space. The property includes 58 parking spaces. The purchase price for the

property was approximately $4.62 million.

On March 15, 2019, the Company entered

into a stock purchase agreement with Patrick Calderone, the CEO and owner of AVX, whereby the Company purchased 100% of the outstanding

stock of AVX (the “AVX Acquisition”) for $890,716. The purchase price was structured as follows: (1) $550,000 payable

in cash at closing; (2) $290,716 payable in 39,286 shares of the Company’s common stock issued upon closing; and (3) $50,000

payable in the form of a secured promissory note at 6% interest over 12 months secured by six shares of AVX common stock. In connection

with the AVX Acquisition, Patrick Calderone also entered into a consulting agreement with the Company pursuant to which he would

offer consulting and training services during the 12-month period following the closing of the AVX Acquisition. Since AVX is an

installer of smart home products, and since we anticipate that our Ubiquitor device is capable of enhancing smart home installations,

we believe that this acquisition will allow us to test new applications and the integration capabilities of our Ubiquitor device

in smart homes.

On November 15, 2019, Dr. Edward Lee resigned

as President and was appointed to be the Chairman of the Board of Directors.

Patent, Trademark, License and Franchise

Restrictions and Contractual Obligations and Concessions

On November 4, 2016, we filed a U.S. patent

application number 15/344,041 with the USPTO. On March 5, 2018, we issued a press release announcing that the USPTO had issued

an Issue Notification for U.S. Patent Application No. 9924295 entitled “Universal Smart Device,” which covers a patent

application regarding the Company’s Universal Smart Device. The patent was granted on March 20, 2018.

Subsequent to our internal research and

development efforts, we filed with the USPTO on June 2, 2017 a patent application regarding a process for improving the spectral

response curve of a photo sensor. The small and cost-effective multicolor sensor and its related software protected by the potential

patent we believe could achieve a spectral response that approximates an ideal photo response to measure optical measurement. The

patent was issued on February 26, 2019.

In addition, we have been awarded a notice

of allowance for a patent from the USPTO for a patent application we filed on March 12, 2018 as application No. 15/925,400. The

patent title is a “Universal Smart Device,” which is a universal smart instrument that unifies heterogeneous measurement

probes into a single device that can analyze, publish, and share the data analyzed. The issue fee was paid on March 14, 2019.