AS we approach the second quarter of the year, markets continue to be cautiously optimistic amid the global rollout of Covid-19 vaccination programmes, but optimism has been tempered by concerns that an economic recovery could be hurt by fiscally fuelled inflation. In addition, for Malaysia, the absence of a supercharged glove mania this year could make a regional laggard of the benchmark FBM KLCI, analysts say.

Worries of higher inflation in the US, the result of extremely expansive fiscal stimulus and ultra-accommodative monetary policies, are especially concerning.

“Even though US inflation prints have remained benign, they are lagging indicators and the crux is expectations of higher inflation have been building up,” UOB says in its Quarterly Global Outlook 2Q2021 report.

“The combination of vaccine-driven reflation expectations, the US ‘going big’ on fiscal stimulus and inflation fears that could lead to earlier-than-expected monetary policy tightening has led to US Treasury yields spiking higher in the first quarter of 2021.”

While inflation concerns could affect the Malaysian market, Kenanga Research head Koh Huat Soon tells The Edge that inflation is likely to rise gradually, without disrupting market recovery or causing central banks to tighten their monetary policies.

“This situation started in the first quarter, judging from market signals in the Treasury bond market. If inflation goes up, so will cost of debt, which will pose a challenge to borrowers. The 10-year sovereign yield affects risk-free rates, which is a component of stocks valuation. Hopefully, this becomes clearer in the second quarter,” he says.

Koh observes that the US Federal Reserve has been guiding the rate to 2.2% this year and towards 2% by year-end, which is a “nice pace of inflation growth” and provides a clear path for investors in the stock market.

He says Putrajaya is also comfortable with Malaysia’s inflation growth, adding that “the outlook is sanguine”.

MIDF Amanah Investment Bank Bhd research head Imran Yassin Yusof sounded a note of caution, however. He observes that the FBM KLCI could become a laggard this year compared to its peers, as the glove sector — a major component of the index — appears to have fallen out of favour now that Covid-19 vaccinations are underway.

“At the moment, major risks to the US market would come from the bond market. Concerns over rising inflation there have caused bond yields to spike. We have seen a selloff in the tech sector on worries over rising borrowing costs. This may induce the Fed to react by reducing its bond purchases, leading to what we call ‘taper tantrum’, similar to the one we saw in 2013. If this were to happen, we can expect that it will affect the global equity markets, including ours,” Imran explains.

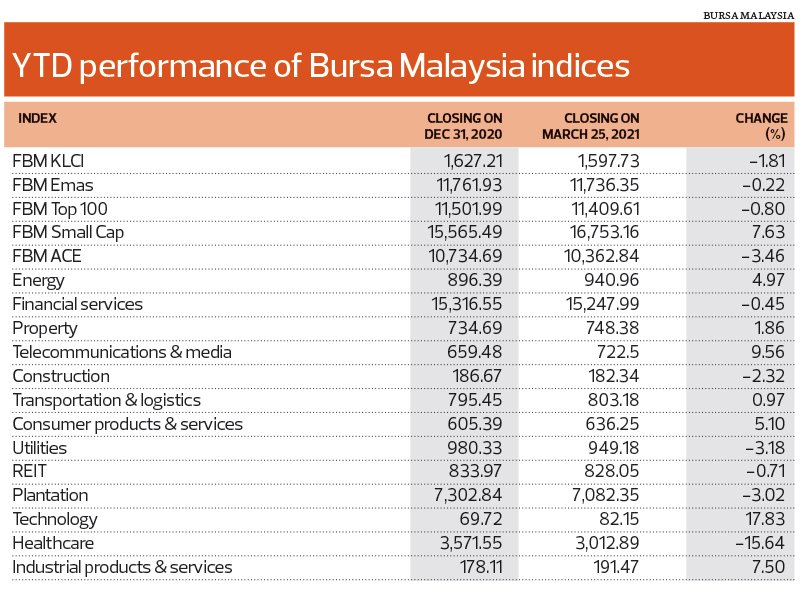

For the first quarter, he says the market more or less performed within expectations despite downside risks, which included the implementation of the Movement Control Order 2.0, a declaration of a national emergency from Jan 12 to Aug 1, and a spike in bond yields.

“As mentioned, however, we believe the underlying trend is on an upward bias. Thus, we believe any pullback in the market will be an opportunity for investors to accumulate. As such, we are maintaining our 1,700 year-end FBM KLCI target,” he adds of the benchmark, which is trading around the 1,600 mark.

Recovery play intact, focus on laggards

Kenanga’s Koh believes there is a wider array of counters to recommend this year and, as the economy gains momentum, the second half of the year will outperform the first half.

“There are more sectors we can recommend that people buy this year compared to last year, which was then confined to gloves and a handful of technology stocks. But this year sees a broadening of more attractive buys, from banks to consumer and retail names,” he asserts, noting that oil and gas (O&G) and technology stocks had rallied in the first quarter on the back of “economic reopening”.

“The focus will now be on market laggards,” he says, pointing to banks, which are expected to be beneficiaries of a general economic recovery.

“The risks of further cuts in the overnight policy rate is diminishing considerably, as towards the end of 2021, one hopes that, with the recovery of the economy, credit costs can be reduced,” Koh says, adding that a steepening yield curve is good for banks because they tend to lend long and borrow short, so the extra boost in margins is helpful.

The gradual economic recovery is also expected to benefit retail and consumer players such as Padini Holdings Bhd, 7-Eleven Malaysia Holdings Bhd and Aeon Co (M) Bhd, as well as airlines, airports, Genting Bhd and breweries Carlsberg Brewery Malaysia Bhd and Heineken Malaysia Bhd, he continues.

MIDF Research, meanwhile, is positive about the O&G, plantation, consumer, automotive, banking, construction, healthcare and glove sectors.

Its top picks are Dialog Group Bhd, TSH Resources Bhd, MBM Resources Bhd, Aeon Co, Gas Malaysia Bhd, Hock Seng Lee Bhd, Sunway Construction Group Bhd, Bermaz Auto Bhd, Public Bank Bhd, Kuala Lumpur Kepong Bhd and RHB Bank Bhd.

MIDF’s Imran cites Brent crude touching US$70 per barrel and crude palm oil (CPO) breaching the RM4,000 mark as examples of commodity plays that are expected to continue rising well into the second quarter, fuelled by market liquidity as well as sector specific issues, including drought and terrorism.

Kenanga’s Koh believes that, even though the glove play has lost its steam, glove counters remain fundamentally sound. While the average selling price of gloves per 1,000 pieces has fallen from more than US$100 during the peak of the Covid-19 pandemic to around US$35 at present, it is still higher than pre-coronavirus levels, he adds.

“The fundamentals are still attractive but, [unfortunately,] the sentiments have not held,” says Koh.

TA Investment Management chief investment officer Choo Swee Kee stresses the importance of a good stock-picking strategy in today’s market, given that most counters have appreciated.

“There are some stocks that have gone up significantly but there also many stocks that are still laggards, such as Tenaga Nasional Bhd, MISC Bhd, Dialog and many of the banks. Our strategy is still to pick value stocks and switch out of stocks that have significantly overperformed versus their potential growth forecasts. Our strategy also includes revisiting sectors such glove, which has corrected significantly, as well as sectors such as technology, which is currently undergoing correction,” Choo explains.

Koh believes the tech sector will continue to be favoured, notwithstanding concerns it is already overvalued. “The tech sector is on a circular theme, driven by developments in electric vehicles as well as recovering global motor sales, which will benefit the likes of high-end audio product manufacturer Bang & Olufsen and integrated circuits manufacturer and assembler Malaysian Pacific Industries Bhd.”

In addition, the development of 5G will benefit companies such as Inari Amerton Bhd, which provides radiofrequency components, while the huge demand for cloud computing data centres will also drive demand.

Having noted that foreign investors turned net buyers in March 2021 on a month-to-date basis, MIDF’s Imran says the return of foreign investors may be another theme for 2021. “Although, since then, we have seen net selling, foreign investors are still on a net buying position for the month [as at March 23], amounting to RM182.6 million,” he says, adding that anticipation of a stronger ringgit could be a catalyst.

According to CGS-CIMB Research, foreign investors turned net sellers in the third week of March after two consecutive weeks of net buying, selling mainly utilities, technology and plantation stocks. The top three stocks that attracted foreign selling were Tenaga, Dagang Nexchange Bhd and Inari, while stocks that saw the highest foreign inflows were Supermax Corp Bhd, D&O Green Technologies Bhd and Malayan Banking Bhd. This has resulted in year-to-date foreign net sell expanding to RM1.3 billion.

In a strategy note, CGS-CIMB Research head Ivy Ng notes that retail investors emerged as sole net buyers of Malaysian equities in the week of March 15 to 19, with the top three net buys being Tenaga, Top Glove Corp Bhd and Widad Group Bhd.

“Local institutional investors continued their weekly net selling spree, albeit lower by 4% week on week at RM352 million; year-to-date net sell flow is at RM4.5 billion. Their five key net sells were Top Glove, Maybank, Public Bank, G3 Global Bhd and Supermax,” she says.

Top Glove topped the retail’s and nominees’ net buy lists but was on the top sell list for local institutional investors.

Local institutional investors were top buyers of Mr DIY Group (M) Bhd, while nominees and proprietary investors were top sellers. Retail investors were top buyers of Tenaga, while foreign investors were key sellers.