While supply constraints that are impacting some players will continue into the next year, the strong demand environment is allowing companies to raise prices.

The longer-lasting impact of the pandemic is overwhelmingly positive for the industry because it provides the building blocks of technology that everyone is relying on for maintaining social distancing and remote operations.

Moreover, technological advancements in the way we do computing, as well as artificial intelligence, Internet of Things, 5G, driverless cars and a host of other things that will greatly increase our reliance on the digital world are secular drivers for the industry.

Therefore there are huge prospects in this market and it’s a place we should all be in. Our current picks are MACOM Technology Solutions, Analog Devices and Microchip Technology Incorporated.

About the Industry

We generally use our electronic gadgets without thinking, expecting them to understand our operating environment, read our commands correctly and store, retrieve and process the information we throw at them.

But what goes on behind the process is complicated, and enabled by semiconductor technology, whether analog (enabling the recording and measurement of real world information), digital (processing information available in machine-readable language) or mixed signal (enabling conversion of analog signals to digital or digital to analog among other things). So most electronic gadgets use a combination of these semiconductor devices.

The industry is cyclical, making for periods of expanding capacity and supply that outpace demand followed by periods during which the growing demand matches then exceeds supply. So there is a certain elasticity in prices. Moreover, these semiconductor components have wide application across automotive, communications, computing/cloud/data center, industrial, medical, IoT and other markets, so players can serve multiple markets that offset their individual seasonality.

Some of the leading players in the industry include Analog Devices (ADI – Free Report) and Maxim Integrated Products (MXIM).

Here are the major themes for the industry:

- The increasing use of electronics in vehicles, airplanes and defense equipment; increased factory automation; greater penetration of smartphones, tablets, notebooks, PCs and all manner of personal computing and other personal devices and smart household appliances; communications infrastructure moving to 5G; greater reliance on cloud infrastructure; the advent of artificial intelligence (AI), the Internet of Things (IoT), more advanced medical devices, EVs, self-driving cars etc is leading to unprecedented demand for semiconductor chips. Since we simply aren’t making as many chips as we need, supply chains are being optimized to the maximum. Since the pandemic hit in such a situation, manufacturers had no option but to divert production to things immediately in demand, which in this case were the cloud, household items, personal computing and devices, etc. But when people wanted to move out again, they preferred their own transportation, which increased demand for vehicles. But production diverted to these other things simply can’t be redirected at such short notice. And this is the reason behind the global chip shortage. Company chiefs are guessing that the great shortage will continue well into next year despite huge efforts to bring new capacity online. And of course, this will lead to strong pricing.

- With vaccines rolling out rapidly, many segments of the economy that were only partially operational are expected to open up while not all the work and school that moved home is coming back. This is leading to the hybrid model, where more people move out of their homes more often but not all the time. This is likely to expand the overall electronic footprint, which should also be positive for the industry. So, while demand for traditional computing equipment like PCs and newer-age tablets should remain strong as more work and education is done at home, consumer devices incorporating newer technologies to enable more experiences, will continue to join. The number of semiconductors per device and their complexities will constantly increase. R&D budgets focused on responding to increased competition and the expanding scope of digitization will therefore also increase.

- Secular driversfor the industry are like data center growth (from the continuing shift in workloads to the cloud, which was accelerated by the virus), the advent of artificial intelligence (which is huge because it will permeate every aspect of life and living and is still a market in the making) and IoT (which is another market in the making and will tremendously expand the scope of computing).

- The adoption of 5G communications technology, enabling 10X the data rate as 4G, will be a huge boost to analog-mixed signal sales both in base stations and end devices. Because of the multiple input (MI) and multiple output (MO) streams the technology will enable in base stations, demand for sensors and power management analog including envelope tracking chips (to manage excess power flow and thus reduce heating), as well as gallium nitride (GaN) materials will increase. Moreover, since 5G is only involved in short range signals, it will not totally replace 4G but will supplement it. So it will be additive in terms of component demand. This is also a brighter spot, but a slowdown until the virus impact is clearer seems inevitable.

- While industry consolidation continues as the cost of making chips rises, M&A activity will be increasingly difficult because a lot of consolidation has already happened. At the same time, the goals of expanding capabilities and acquisition of key talent remain as important as ever.

The challenge of rising cost and complications of fabricating chips remains while their broader adoption across devices of varying value requires prices to decrease.

There’s also a longer term challenge with respect to China, which is bringing new fabs online with the goal of becoming number one in several key technologies. The resultant locking of horns with the U.S. can cause disruptions.

Zacks Industry Rank Indicates Attractive Prospects

The Zacks Semiconductor – Analog and Mixed industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #65, which places it at the top 26% of more than 250 Zacks-classified industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates attractive near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions over the past year, analysts appear to have gotten more and more enthusiastic about this group’s earnings growth potential. This sentiment continued through Feb ‘21 and stabilized thereafter. Overall, 2021 Estimates have risen 24.9% over the past year, while for 2022 they’ve risen 7.5%.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Leads on Stock Market Performance

The Zacks Semiconductor – Analog and Mixed industry has been ahead of the broader Zacks Computer and Technology Sector as well as the S&P 500 index over the past year with the gap widening since November.

Overall, the industry added 79.0% to its value over this period compared to the broader sector’s 65.9% gain and the gain of 50.0% for the S&P 500.

One-Year Price Performance

Industry’s Current Valuation

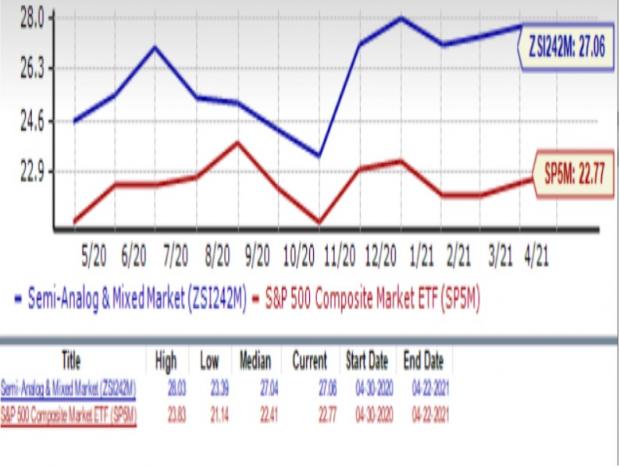

On the basis of forward 12-month price-to-earnings (P/E) ratio, which is a commonly used metric for valuing semiconductor companies, we see that the industry is currently trading at a 27.06X multiple compared to the S&P 500’s 22.77X. It is however slightly undervalued compared to the sector’s forward-12-month P/E of 29.29X.

The industry is currently trading close to its median value of 27.04X. The annual range is 23.39X to 28.03X.

Forward 12 Month Price-to-Earnings (P/E) Ratio

3 Stocks Offering Exposure to the Industry

MACOM Technology Solutions Holdings (MTSI – Free Report) : The company develops and produces power analog chips including radio frequency (RF), microwave and millimeter wave semiconductor devices and components for application in optical, wireless and satellite networks. Its primary customers are in the telecom (39% revenue share), industrial and defense (37%) and data center (24%) markets.

So MTSI operates in attractive markets that have significant growth potential. The company is focused on bringing to market its new and more differentiated products at an accelerated pace so as to capture a bigger share of its addressable market that management estimates at around $5 billion. It already has product content in antenna systems as well as in front haul, mid haul and metro long haul optical systems. So new products, set to release over the next 6-12 months should drive further share gains. At the same time, it also continues to invest in its U.S. fabs as a strategy for differentiating its products.

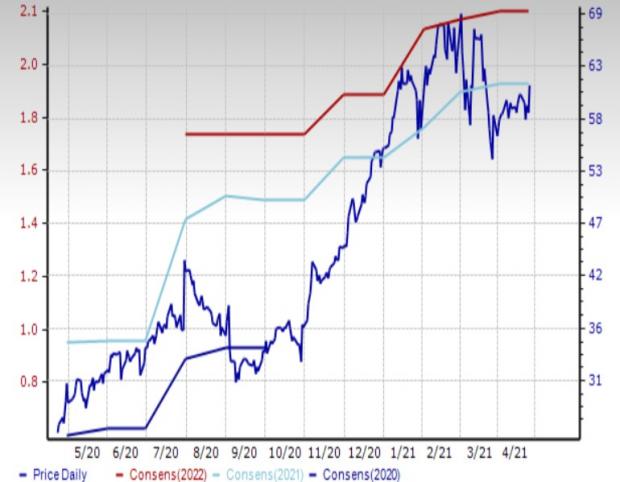

After topping estimates by 9.5% in the last quarter, the current year EPS estimate of this Zacks Rank #2 (Buy) stock increased 15.2% from $1.64 to $1.89.

The shares are up 140.0% over the past year.

Price and Consensus: MTSI

Analog Devices, Inc. (ADI – Free Report) : Analog Devices is an original equipment manufacturer of high performance semiconductor devices, specifically, analog, mixed signal and digital signal processing (DSP) integrated circuits.

The semiconductor shortage, unprecedented demand, bookings momentum and lean inventories are testimony of the strong demand environment and are helping prices across the industry. In addition, the diversity of ADI’s business and its alignment with the most important secular growth trends are big positives.

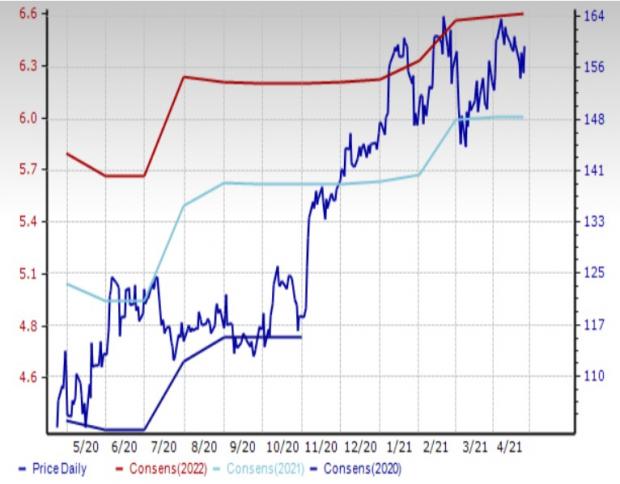

The company topped the Zacks Consensus Estimate by 9.1% in the last quarter, after which the current year EPS estimate of this Zacks Rank #2 stock increased 5.6% from $5.69 to $6.01.

The shares are up 56.5% over the past year.

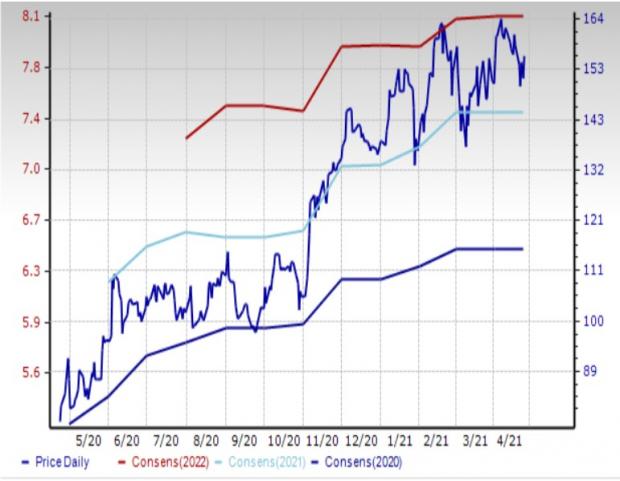

Price and Consensus: ADI

Microchip Technology Inc. (MCHP – Free Report) :

Microchip develops and manufactures microcontrollers, memory and analog and interface products for embedded control systems, which are small, low-power computers designed to perform specific tasks.

The company is seeing particular strength in the automotive, industrial and consumer markets, which are seeing above-seasonal strength. The computing market that surged last year is closer to normal seasonality as the economy heads toward a broader re-opening. Low channel inventories and supply constraints are raising some material and subcontracting costs while high demand is allowing price increases.

The company topped the Zacks Consensus Estimate by 2.5% in the last quarter, after which the current year EPS estimate of this Zacks Rank #2 stock increased 2.1% from $6.34 to $6.47.

The shares are up 98.1% over the past year.

Price and Consensus: MCHP

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year’s 2020 Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.