Rapid deployment of 5G networking is driving the proliferation of Internet of Things (IoT), Advanced Driver Assistance Systems (ADAS), Augmented Reality/Virtual Reality (AR/VR) devices.

Further, democratization of 5G smartphones is a tailwind for the industry players. This has bolstered the demand for RF semiconductor products, which favors the prospects of prominent industry players, including Skyworks (SWKS), Qorvo (QRVO), and Resonant (RESN).

Thereby, the outlook for the Zacks Semiconductors – Radio Frequency industry appears encouraging at the moment. Nevertheless, lingering impacts of coronavirus pandemic led supply chain disruptions remain an overhang.

Industry Description

Contents

- 1 Industry Description

- 2 4 Trends Shaping the Future of the Semiconductors – RF Industry

- 3 Zacks Industry Rank Indicates Bright Near-Term Prospects

- 4 Industry Outperforms S&P 500, Lags Sector

- 5 One Year Price Performance

- 6 Industry’s Current Valuation

- 7 Forward 12-Month P/E Ratio

- 8 Forward 12-Month P/E Ratio

- 9 3 Semiconductor RF Stocks to Keep a Close Eye on

- 10 Price and Consensus: SWKS

- 11 Price and Consensus: QRVO

- 12 Price and Consensus: RESN

- 13 The Hottest Tech Mega-Trend of All

The Zacks Semiconductors – Radio Frequency Industry comprises companies that provide Radio Frequency (RF) solutions, Front-end Modules (FEMs), low-noise amplifiers, diodes, multi-chip modules (MMICs) and optical components.

The industry participants also offer surface acoustic wave (SAW), bulk acoustic wave (BAW) technology-based antenna-plexers, and film bulk acoustic resonator (FBAR) filters to enable smartphone devices to function more efficiently in congested RF spectrum.

The industry players serve a wide array of industries with their solutions finding ample application in 5G and smartphone equipment, aerospace and defense, optical networks, cellular base stations, automotive and smart home applications.

Most of these companies utilize robust wafer fabrication technologies to gain competitive edge over peers. The companies also leverage ZigBee, Bluetooth Low Energy (BLE), Thread, silicon germanium and Gallium Nitride (GaN) technologies across their portfolio in a bid to stay ahead of the curve.

4 Trends Shaping the Future of the Semiconductors – RF Industry

Accelerated Deployment of 5G Favors Growth Prospects: Rapid implementation of 5G networking infrastructure and robust adoption of cloud computing applications hold promise considering the wireless communication market. Coronavirus crisis-induced work-from-home wave has necessitated the need for higher bandwidth and triggered LTE advancements, which are expected to bolster demand for RF power amplifiers. Additionally, the launch of iPhone 12 is anticipated to benefit the top-line performance of both Qorvo and Skyworks at least in the near term. Notably, both the companies derive significant revenues from Apple (AAPL), which is poised to gain from the incremental adoption of its latest iPhones.

Rebound in Smartphone Market is a Tailwind: Demand recovery in the smartphone market is likely to aid prospects of major industry players, including Qorvo, Skyworks, Resonant, Akoustis (AKTS) and RF Industries (RFIL). Notably, per latest Canalys data, worldwide smartphone shipments hit 348.0 million units in third-quarter 2020, up 22% on a sequential basis, reflecting uptick in adoption. Further, the roll out of new bands and band combinations has led to considerable design challenges for OEM smartphone manufacturers. The industry participants, like Qorvo, are looking to address these challenges with a robust range of antenna-plexers portfolio utilizing BAW technology. Moreover, IDC estimates that coronavirus crisis-induced shift in consumer spending patterns toward lesser mobile devices is likely to lead to aggressively priced 5G smartphones. This is anticipated to accelerate the democratization of 5G smartphones and boost prospects of the industry players.

Innovation is Opening New Business Avenues: Easing shelter-in-place guidelines, as economies started to reopen, has led to growing clout of contact tracing applications in Ultra-Wideband (UWB) technology-based wearable devices. Increase in production ramp of such wearables is opening up new opportunities for industry participants. Rapid proliferation of IoT, wearables, drones, VR/AR devices, autonomous cars, and ADAS is expected to bolster the demand for RF semiconductor products beyond smartphone devices, which favors industry prospects. Notably, RF Semiconductors are setting the pace for technology modernization, consequently digitizing aspects like connectivity, healthcare, transport, defense, among others. For instance, Qorvo is gaining from rapid adoption of GaN for high-power defense applications and emerging healthcare applications. Diversified utilization of RF Semiconductor products bodes well for the industry players. Moreover, evolution of semiconductor manufacturing processes from 10 nanometer (nm) to 7 nm and even 5 nm technology is anticipated to bolster the industry’s prospects.

Coronavirus Crisis Induced Macroeconomic Weakness to Hinder Prospects: The industry players are reeling under the impact of the coronavirus crisis-induced macroeconomic woes. The COVID-19 crisis led imposition of second round of lockdowns remains a concern. This had previously compelled semiconductor companies to shut down production facilities temporarily, which has raised concerns regarding the industry’s prospects. The supply chain has been disrupted by social distancing and shelter-in-place restrictions owing to the ongoing pandemic, which in turn has severely impacted these companies. Although economies are gradually reopening in several parts of the world; production delays and increasing infected cases remain major concerns. Moreover, the U.S.-China trade war induced tariffs and Huawei ban have been hindering growth of the industry participants for quite some time now. Markedly, the industry players generate significant portion of their revenues from China.

Zacks Industry Rank Indicates Bright Near-Term Prospects

The Zacks Semiconductors – Radio Frequency Industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #33, which places it at the top 13% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks, that you may want to add to your portfolio, given the bright prospects, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Outperforms S&P 500, Lags Sector

The Zacks Semiconductors – Radio Frequency Industry has outperformed the S&P 500 but lagged its own sector in the past year.

One Year Price Performance

The industry has gained 30.2% over this period compared with the S&P 500’s and broader sector’s rally of 15.3% and 35%, respectively.

Industry’s Current Valuation

On the basis of forward 12-month price-to-earnings ratio (P/E), which is a commonly used multiple for valuing Semiconductors – Radio Frequency stocks, the industry is currently trading at 19.41X, lower than the S&P 500’s 22.56X and the sector’s 26.92X.

Over the past five years, the industry has traded as high as 24.12X and as low as 10.01X, with the median being at 13.09X, as the charts below show.

Forward 12-Month P/E Ratio

Forward 12-Month P/E Ratio

3 Semiconductor RF Stocks to Keep a Close Eye on

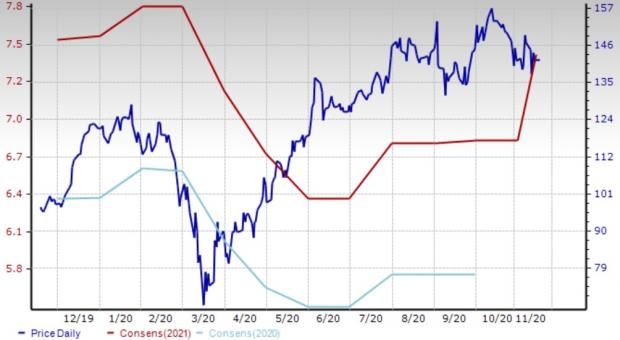

Skyworks: Skyworks is benefiting from increasing demand for 5G handsets. Moreover, the Irvine, CA-based company’s Sky5 product portfolio facilitated several 5G smartphone launches, and its offerings were selected by Samsung, VIVO, Xiaomi and other Tier-1 players.

Further, this currently Zacks Rank #1 (Strong Buy) company’s diversified portfolio positions it well to capitalize on momentum witnessed across telemedicine, emergency response applications and remote work, online learning, and video streaming triggered by coronavirus crisis. You can see the complete list of today’s Zacks #1 Rank stocks here.

Markedly, shares of Skyworks have appreciated 45.2% in the past year. The Zacks Consensus Estimate for fiscal 2021 earnings for the company has improved by 9.6% to $7.45 per share over the past 30 days, indicating year-over-year growth of 21.5%.

Price and Consensus: SWKS

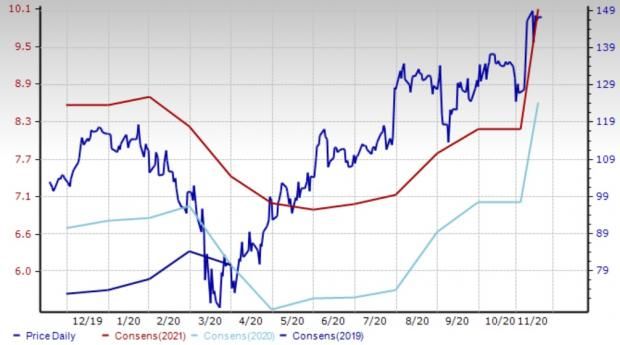

Qorvo: Qorvo, currently sporting a Zacks Rank #1, is riding on gains from increased demand for 5G handsets and robust improvement in the Infrastructure and Defense Products business.

Strength in smartphone vertical, upgrades in 5G smartphones, and gains from consistent growth in 5G infrastructure, power management, 5G base stations, Wi-Fi 6 solutions and defense end-markets is anticipated to drive financial performance.

Solid uptake of BAW antenna-plexers, as economies started to reopen, is expected to boost top-line growth. Moreover, expanding portfolio of 5G base solutions amid accelerated deployment of 5G bodes well. Besides, growing momentum for Qorvo’s GaN technology-based solutions is a positive.

Notably, shares of Qorvo have surged 45.5% in the past year. The Zacks Consensus Estimate for fiscal 2021 earnings for the Greensboro, NC-based company has improved 22% to $8.61 per share over the past 30 days, indicating year-over-year growth of 36%.

Price and Consensus: QRVO

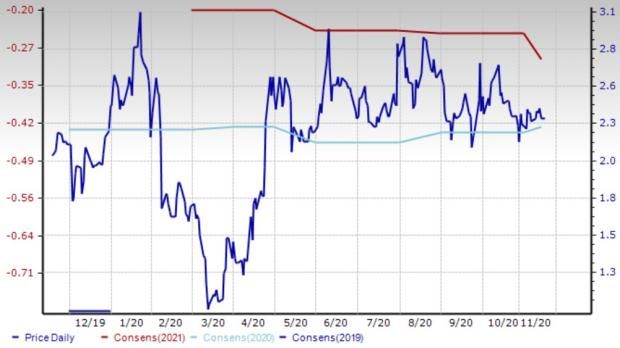

Resonant: Resonant is well poised to benefit from the growing clout of its high-performance XBAR 5G filters in mobile devices. Markedly, utilizing this Goleta, CA-based company’s technology, its customers have shipped over 46.5 million units to date.

Moreover, this presently Zacks #3 (Hold) Ranked company, remains well-positioned to reap benefits from the robust uptake of high-value band designs in the automotive market, which is recovering amid reopening of economies.

Resonant stock has climbed 12.6% in the past year. The Zacks Consensus Estimate for 2020 bottom line is pegged at a loss of 43 cents per share, narrower than the year-ago reported loss of $1.02.

Price and Consensus: RESN

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it’s predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce “the world’s first trillionaires,” but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks’ 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Skyworks Solutions, Inc. (SWKS) : Free Stock Analysis Report

RF Industries, Ltd. (RFIL) : Free Stock Analysis Report

Resonant Inc. (RESN) : Free Stock Analysis Report

Qorvo, Inc. (QRVO) : Free Stock Analysis Report

Akoustis Technologies, Inc. (AKTS) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research