Qualcomm has become one of the global leaders in 5G on the back of baseband modems that dial into the next-generation networks. But the mobile chip giant is also making a bigger play in radio-frequency (RF) chips that surround the cellular modem, RF transceivers, and antennas and carry out tasks such as amplifying and filtering radio signals, suctioning up more of the bill of materials (BOM) in 5G phones.

The San Diego, California-based company said its radio-frequency front-end (RFFE) business soared to more than $900 million in its second quarter, up 39% year over year, buoyed by stronger demand for 5G phones. Qualcomm has landed supply agreements for RF components and modules with Samsung and Google as well as Xiaomi, Oppo, and Vivo, which are taking advantage of China’s ambitious 5G rollout.

“We’re winning not only at the system level; we’re winning at the component level,” said Cristiano Amon, Qualcomm’s president and incoming CEO, on its quarterly conference call with analysts last month. He said Qualcomm is not only landing sockets for its millimeter-wave components in 5G parts of phones but it is also winning orders for chips that support 4G and sub-6 5G, where it faces more competition.

“The fact we’re winning designs across the board, it’s a testimony that our strategy is working,” he said.

The company’s ambitions are raising the stakes in the more than $20 billion radio frequency IC market, which is on pace to reach $25.8 billion by 2025, according to market researcher Yole Developpement. The smartphone chip giant is trying to close the gap in market share with Skyworks, Qorvo, Murata, Broadcom, and other industry leaders that dominated different parts of the RFFE in 4G LTE phones.

Apple, Samsung, Google, and other players in the smartphone arena are paying hefty premiums for RF chips, which are critical to getting the best possible performance out of new 5G phones. Qualcomm has been expanding its footprint in the market in recent years with new power amplifiers, switches, RF filters, antenna tuners, LNAs, and other chips often packaged in diversity and power amplifier modules (PAMs). These chips are playing more of a central role as the guts of 5G phones become far more complicated.

Qualcomm said that there are more than 10,000 combinations of frequency bands used in 5G globally, up from 1,000 currently used by 4G networks, which is increasing the cost and complexity of the RFFE. These bands include millimeter waves, which are very fast but can only travel limited distances and are vulnerable to being blocked by walls or other obstructions, including a person’s hand holding the phone.

Qualcomm has rolled out 5G modems that also support the sub-6 bands widely used by 5G networks in China and other regions, relaying signals over longer distances than the millimeter waves favored by US telecom giants. Both types of 5G technology place different demands on the RFFE in the phone, forcing electronics manufacturers to cram more RF chips in their devices to accommodate all these variations.

“As 5G millimeter wave technology expands into other geographies, we expect significant expansion of our RF opportunity due to increased silicon content and value,” said Amon.

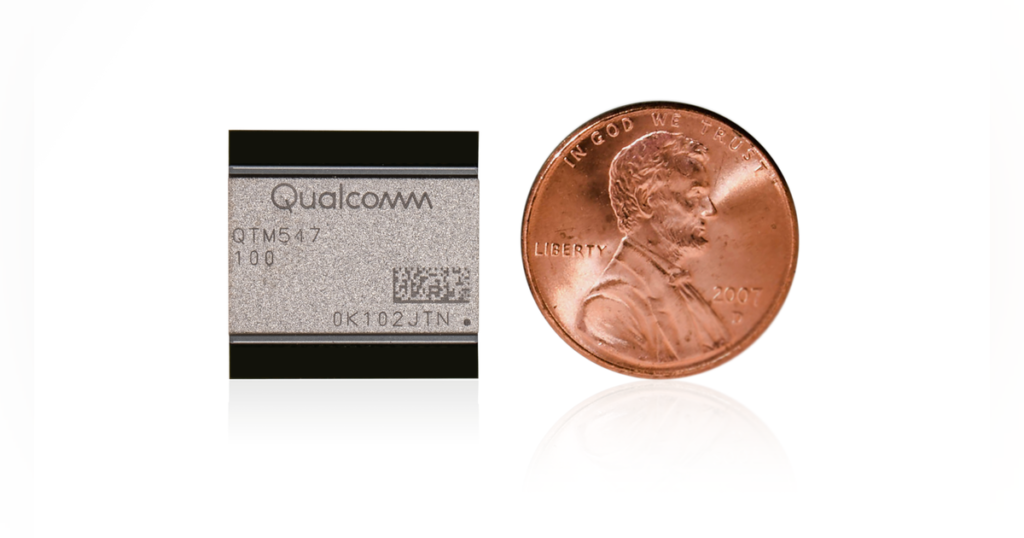

Qualcomm is trying to persuade phone makers to buy its radio frequency chips—pre-integrated with its 5G modems, RF transceivers, and millimeter-wave antennas—instead of buying them all from separate vendors and assembling them part by part. Qualcomm was one of the major standard-bearers behind 5G, giving it an early lead in incorporating the standard with support for all global 5G bands—including millimeter waves where other firms struggled with early in the 5G era—in its modem chips and RF ICs.

Skyworks CEO Liam Griffin has previously said that the BOM cost of the RF components in the average smartphone would rise by roughly 40% from around $18 in current 4G phones to $25 in 5G models.

Qualcomm said these types of pre-integrated solutions bring boosts in power efficiency to the signal chain and reduce the real estate of the RF subsystem in 5G handsets. Qualcomm dominated the first generation of 5G phones from Samsung Electronics, LG Electronics, Xiaomi, and other vendors, which leaned on its suite of RF components to reduce development costs and ease the burden of integration.

“5G presents a level of complexity that our advanced RF front-end solutions and comprehensive portfolio can uniquely resolve,” Christian Block, SVP and GM of the RFFE business at Qualcomm, said in February. Last month, executives said that more or less every 5G phone based on its 5G modems—totaling more than 200 design wins—also leverage its 5G RFFE solutions for both sub-6 bands and millimeter waves.

But it is facing questions about its ability to fill out its market share as Skyworks, Qorvo, Broadcom, and other rivals roll out RF components and modules supporting both millimeter waves and other 5G bands.

Last year, Broadcom landed major, multi-year supply deals with Apple, its largest smartphone customer. Broadcom said that it agreed to supply a wide range of wireless components, including ICs used in the RFFE, for Apple products. Broadcom, which was working to sell its RF chip business before it reached the deal with Apple, said the three-and-a-half-year agreements will deliver around $15 billion by 2024.

While Broadcom sells power amplifiers, switches, and other RFFE chips, the crown jewel of its product family is the FBAR filters. FBARs are widely used in 4G and 5G smartphones and base stations to filter out stray signals from radio transmissions. Broadcom CEO Hock Tan said the Apple deals give it more “clarity” around its long-term roadmap in 5G phones and positions it to continue to invest in the sector.

Skyworks is also expanding its production of RF filters that are specifically designed for the wide range of frequency bands used by 5G technology and integrating them in RF modules that it is selling to Apple, Samsung, and other smartphone giants. The company said it has focused on the development of BAW filters based on its proprietary IP that can better handle the high bandwidths and power levels for 5G.

“We know how hard it is to deliver a 5G socket with all the bells and whistles that can handle spectrum across the board, the complexity of roaming, the size constraints, and current consumption. It is really hard. So we’ve spent a long time creating a solution that makes it very easy for our customers to go to market,” Griffin said about Skyworks’ Sky5 RF modules on a conference call with analysts last month.

Qorvo has started supplying its RF Fusion family of integrated modules to all the largest 5G smartphone manufacturers. The modules encompass the major 4G and 5G frequency bands and integrate its power amplifiers, filters, switches, LNAs, and RF shielding to handle transmit and receive coverage at the same time. The modules also feature different configurations for different regions, including the US and China.

“As 4G became more complex over the past couple of years, the move towards integration began to take off. And then when 5G emerged, there really was no looking back for our customers that are bringing out new high-performance handsets,” said Steve Creviston, president of Qorvo’s mobile products, earlier this year. Qorvo is winning sockets in the “main path” of 5G phones in all three major types of bands, he said.

But as its first-mover advantage continues to fade and its competitors lure in smartphone makers with new RF offerings, Qualcomm is also under pressure to stand out at the component and module levels.

In February, the company rolled out a new integrated 4G and 5G power-amplifier module, the QPM6679, which can supply the power required by the higher frequency bands used in 5G. These power amplifiers translate data into radio signals that are beamed out to cellular base stations. It also upgraded its latest dual-band diversity receive module, the QDM5579, to further amplify radio signals while limiting noise.

The power amplifier can be paired with its QET7100 wide-band envelope tracker to prolong the battery life of the latest phones for 5G. With 100 MHz of bandwidth, the chip supports up to 30% more power efficiency and higher transmit power in a smaller die area than the average power-tracking technology from rivals. It also supports all global 5G bands in the sub-6 range and 4G bands, the company added.

The improved power efficiency comes from its ability to follow the output of multiple 4G and 5G power amplifiers. Wide-band envelope tracking is considered critical for managing the power to 5G radios.

Last year, the mobile chip giant introduced its UltraSAW filter technology, its new category of RF filters featuring improved insertion loss to isolate signals from any interfering radio transmissions. The chips, which entered mass-production at the end of last year, are designed to compete against other RF filters, including BAW filters from Qorvo and Skyworks and FBARs from Broadcom, in the sub-6 bands.

The company also introduced its proprietary antenna-tuning technology that uses AI to identify where hands are gripping a smartphone and then fine-tune the antennas in real-time to improve performance for 5G. Qualcomm said the AI antenna tuning technology could boost performance by up to 3 dB in the transmit chain and 4 dB in the receive chain, resulting in faster upload speeds and improved coverage.

Qualcomm has closed the gap with Broadcom, Qorvo, and Skyworks in the RFFE market. But as the cost and complexity of the RFFE continue to grow, the bar to beat out the competition is higher than ever.