China’s Huawei Technologies is ramping up investment in local chip companies to plug holes in its semiconductor supply chain caused by the US crackdown on the tech giant.

Huawei, the world’s largest telecom equipment provider and No. 2 smartphone maker, is engaging with several Chinese chipmakers for possible investment while also working to maintain its own chip design development, two people with knowledge of the matter told Nikkei Asia.

The Chinese company has been cut off from many of its most important global suppliers since Washington imposed trade restrictions on the use of American technology, even by non-US companies, to supply Huawei.

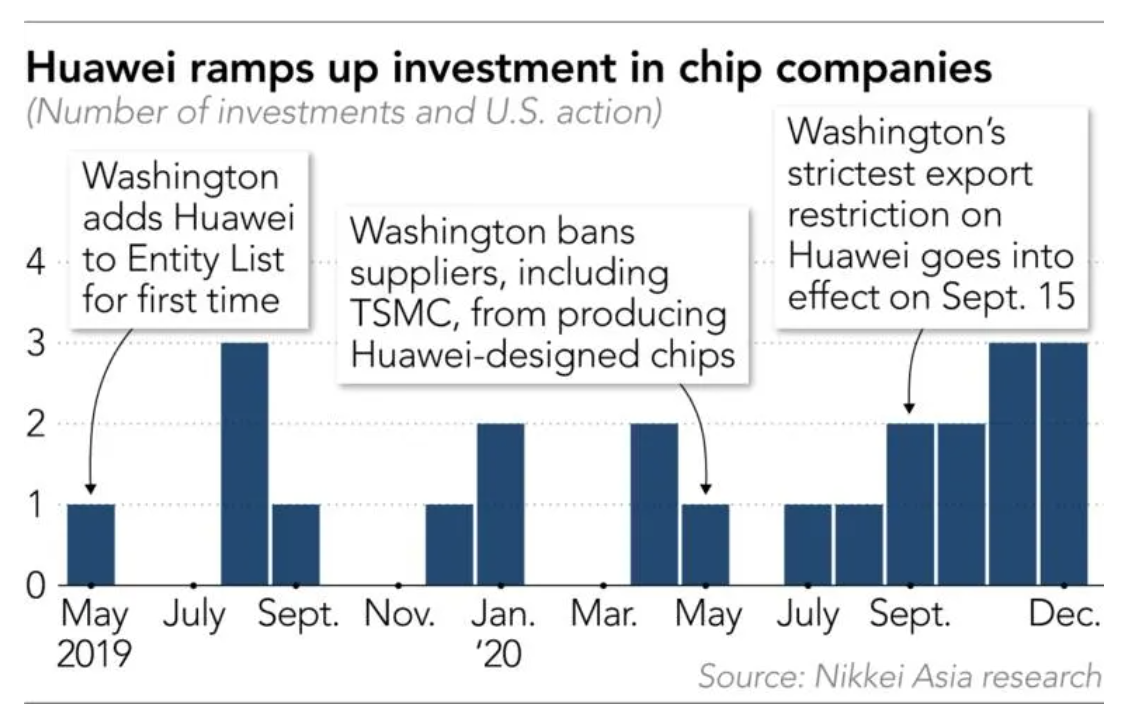

Huawei has already taken stakes in 20 semiconductor-related companies over the past year and a half, an analysis of investment data by Nikkei Asia shows, with half of those deals coming in the past five months. Those investments cover chipmaking sectors currently dominated by companies from the US, Japan, South Korea, and Taiwan, such as chip design tools, semiconductor materials, compound semiconductors, and chip production and testing equipment.

The acceleration of investment and the range of targets underscore the company’s eagerness to free itself from US restrictions and maintain its tech development.

The Chinese national tech champion is also quietly building a small-scale chip production line for research purposes in Shenzhen, where it is headquartered, multiple people said.

“Broadly speaking, the importance of Huawei’s R&D production line in Shenzhen is to help accelerate chip development and to make sure all its designs can later be put into production smoothly,” one of the people said. Construction of the line began in the latter half of 2020, according to sources.

On the investment front, Huawei is looking to fill gaps in its chip supply chain and is receiving government assistance to do so.

“Local government officials are helping Huawei look for targets for investment,” one source said. “The company aims to step into any area that it lacks in chip development, from chip production, materials, and equipment, to design software.”

Huawei is in talks to invest in SiEn (QingDao) Integrated Circuits, a chip manufacturer founded in 2018, the source said, adding that it has the support of the local Qingdao government for the deal. The investment would provide Huawei with access to a broad range of integrated chip development services, from design and production to packaging and testing.

Huawei has stepped up its investment activities mainly through Hubble Technology Investment, its wholly owned venture capital arm with paid-in capital of RMB 2.7 billion (USD 417 million). The investment arm was set up in April 2019, a month before Washington added Huawei to a trade blacklist that restricted access to American technology. Since then, Hubble has made strategic investments in at least 25 Chinese tech companies, of which 20 are semiconductor-related, according to a Nikkei analysis of data from Qichacha, a Chinese provider of business data.

Of the 25 investments, 18 were made in 2020. Ten of them took place after the US Commerce Department in August further tightened export control rules to restrict even non-US players from using American technology to supply the Chinese company.

Huawei also made strategic investments in domestic chip developers, focusing on communication semiconductors such as radio frequency chips, analog chips, and antennas, Nikkei‘s analysis showed. US-based Skyworks, Qorvo, Broadcom, and Qualcomm are the leading players in this market.

At least five of Huawei’s investment targets have plans for initial public offerings in China. Others have already gone public. 3Peak, headquartered in Suzhou, debuted on Shanghai’s Star board — the Chinese version of Nasdaq — last September, four months after Huawei’s Hubble took a 6% stake in the company. Founded in 2012, 3Peak focuses on developing analog chips and sees Analog Devices Inc. of the US as a competitor. Frequency filters and antenna developer CaiQin Technology, in which Hubble owns a 4.58% stake, plans to go public on the Star board, according to its prospectus. CaiQin’s top rivals are Skyworks, Qorvo, and Broadcom.

Huawei’s ownership in the Chinese tech companies ranges from 3% to 15%, based on current data. Its most recently recorded investment came in late December, when it bought a 15% stake in NineCube, a Chinese chip design toolmaker founded in 2011 in Wuhan. Chip design tools, also known as electronic design automation tools, are crucial for companies looking to design their own chips. The market and expertise for advanced chip design tools are controlled by only a handful of companies, two of which — Synopsys and Cadence Design Systems — are American. US dominance in this field has made Washington’s most recent export crackdown on Huawei particularly painful.

Huawei’s chip design arm, HiSilicon Technologies, was China’s biggest chip developer and designed the high-end Kirin mobile processors used in Huawei’s premium smartphones, as well as its own networking and server processors for base stations. HiSilicon was also the world’s biggest surveillance camera chip supplier and leading television chip developer. However, most of the chips it developed could not be manufactured because the US demanded that all Huawei’s chip production partners using American technology — including Taiwan Semiconductor Manufacturing Co., the world’s biggest contract chipmaker — stop supplying the Chinese company without a license. Richard Yu, CEO of Huawei’s consumer business group, said the Kirin series will likely “go extinct” due to Washington’s crackdown. Currently, Huawei is relying on inventories of high-end chips it stockpiled over the past two years.

Huawei’s investments also included local companies that supply materials for semiconductors, such as SICC and Tankeblue Semiconductor, which make silicon carbide, as well as chip production equipment makers like Shenzhen Skyverse and Ningbo Allsemi Microelectronics Equipment. Both fields are dominated by US and Japanese companies like Applied Materials, Lam Research, KLA, 3M, Dow Dupont, Tokyo Electron, and Shin Etsu Chemical.

Efforts by the Chinese giant to beef up its chip supply chain are in line with Beijing’s goal of achieving self-sufficiency in semiconductors — a key battleground of the US-China tech war. China’s biggest contract chipmaker Semiconductor Manufacturing International Corp. and memory chipmaker Yangtze Memory are accelerating efforts to strip US equipment out of their production lines, Nikkei reported earlier.

While Huawei has grown more aggressive in its investments, the company has maintained a rather low public profile since announcing it would sell its budget smartphone brand Honor last November. Huawei canceled its annual year-end message, which it usually delivers along with its earnings report for the final quarter of the year. At the end of 2019, Huawei warned that it would face a tough 2020 and would sack underperforming staff. The company reported a significant slowdown in its July-September earnings.

In November, founder Ren Zhengfei told employees that Huawei will have to streamline its business and focus on what is important.

“You cannot do everything, otherwise, you won’t have energy to fight in the future,” Ren said in his speech, which was made public this month on Xinsheng Shequ, the company’s employee community platform.

Huawei declined to comment for this article. SiEn did not respond to Nikkei’s request for comment.

This article first appeared on Nikkei Asia. It’s republished here as part of 36Kr’s ongoing partnership with Nikkei.