Article By : Counterpoint Technology Market Research

The competitive dynamics in the smartphone application processor (AP)/system-on-chip (SoC) market is changing fast for the fabless SoC vendors.

The competitive dynamics in the smartphone application processor (AP)/system-on-chip (SoC) market is changing fast for the fabless SoC vendors such as Qualcomm, MediaTek, Apple, and others. The market outlook for these vendors is being shaped by not only the breadth and depth of the capabilities or tiering of the chipset portfolio but also by the choice, the share of the capacities across different edge-nodes at the foundries.

Global smartphone AP/SoC chipset shipments will grow by 3% year-on-year in 2021, factoring in the impact of supply constraint, rapid growth of 5G smartphones and related competitive dynamics, according to the latest research from Counterpoint Research’s Foundry & Application Processor (AP/SoC) research.

“When we break down our forecast with respect to the current demand-supply dynamics, MediaTek is likely to continue its Q4 2020 momentum into 2021 and likely to capture 37% unit share of all the smartphone AP/SoC shipped for the full the year. This 20% potential annual uptick in demand is a function of competitive 5G portfolio powering sub-$150 5G smartphones manufactured at TSMC without any supply constraint and growing share in 4G segment. Further, MediaTek in the first half of 2021 will benefit from Qualcomm’s current supply constraints around RFICs (radio-frequency integrated circuits) from Samsung’s Austin fab, Power management ICs (PMIC), and relatively lower 5nm production yields,” said Dale Gai, research director at Counterpoint Research.

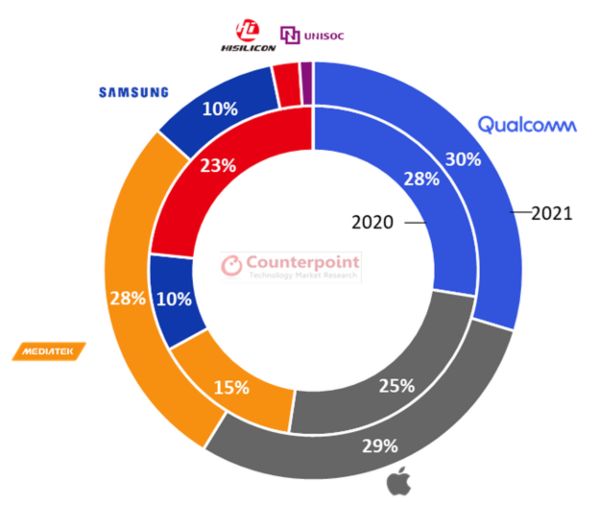

Figure 1: Global Smartphone AP/SoC Market Share (%) Outlook

Source: Counterpoint Research – Foundry & SoC Outlook, Apr 2021

Gai added, “However, we believe Qualcomm to bounce back strongly in H2 2021, firstly by securing greater capacity at TSMC to boost its 5G-centric tiered Snapdragon portfolio. Secondly, taking key steps to improve the supply of PMICs and RFICs should alleviate the supply constraints in coming months. This will allow Qualcomm to maintain its leadership in 5G SoC market and overall market share of 31% still growing annually.”

Highlighting the importance of leading-edge nodes and securing capacities for the same, Gai noted, “The leading-edge nodes, including 7nm, 6nm and 5nm, will account for almost half of the smartphone shipment volume in 2021. These leading nodes are mainly for 5G smartphone models, as advanced nodes (e.g., 11/12/14nm at TSMC and Samsung) will serve the mainstream 4G LTE chipsets in 2021.”

Figure 2: Global 5G Smartphone AP/SoC Market Share (%) Outlook

Source: Counterpoint Research – Foundry & AP/SoC Outlook, Apr 2021

Commenting on the growth of 5G smartphone chipsets, Research Analyst Parv Sharma highlighted, “We estimate Qualcomm to increase its 5G SoC market share to grow to 30% mark in 2021, with 5G solutions across the tiers, from Snapdragon 8-series down to 4-series. If you include 5G baseband shipments to Apple, the overall 5G chipset market share jumps to 59% level. In an ideal scenario, Qualcomm’s market share in 5G segment would have been even higher if it did not face the unfortunate supply constraints in the first half of 2021. As Qualcomm turns to place more wafer orders on TSMC’s 6nm/5nm from Q2 2021, following the below-expectation wafer output of the Snapdragon 888 in the beginning of the year, we expect it to resume its 5G SoC shipment growth from H2 2021.”

He added, “MediaTek leveraging TSMC and its affordable 5G portfolio is well-positioned to almost double its market share in 5G smartphone SoC/AP segment. Together, MediaTek and Qualcomm occupy nearly two-thirds of the 5G smartphone SoC market demand, but the gap between the two has narrowed. Having said that, the foundry capacity will continue to remain tight till early 2022, before the next wave of CAPEX realizes at the leading nodes.”