Automotive product traceability has existed in one form or another for several decades. Traceability generally refers to tracking and tracing each component that comprises every sub-system in a car. Traditionally, this has been achieved with direct part marking on mechanical or electronic components, using 1D or 2D barcodes or radio-frequency identification (RFID). Since vehicle recalls are costly, this process was originated to capture the origins of critical components. Recently, manufacturing traceability has evolved from a defensive mindset of ‘minimizing recalls’ to a proactive posture of ‘compliance.’ As compliance mandates increase, so do the associated fines for non-compliance. The Federal Transportation, Recall Enhancement, Accountability and Documentation (TREAD) Act requires vehicle manufacturers to report to the National Highway Traffic Safety Administration (NHTSA) any excursions on the reliability of the components. As a result, manufacturers rely on traceability to keep abreast of gaps in the value chain to meet end user safety requirements.

Created for the automotive industry, the functional safety standard ISO 26262 mandates traceability for safety-related systems. This requires tracing hardware, software, and firmware back to the system-level design, validation, and testing. Tier 1 system manufacturers and car manufacturers (OEMs) are the key stakeholders who uphold the ISO 26262 traceability. Semiconductor content in vehicles is on the rise, making traceability of components increasingly important. While there’s no specific traceability standard for semiconductor integrated circuits (ICs), relevant work has been done by various stakeholders in the automotive semiconductor supply chain. For example, the Single Device Traceability Task Force that emerged from the SEMI Collaborative Alliance for Semiconductor Test (CAST) has identified the need for device traceability through the supply chain1. This includes not just the traceability of devices but also semiconductor die, lead frames, epoxy, bond wires and printed circuit boards.

Two key automotive application segments, advanced driver-assistance systems (ADAS) and electrification, are expected to undergo significant innovation enabling autonomous electric vehicle (AEV) programs at various automotive OEMs. Several mission-critical safety systems are part of these efforts, including electronic stability control, lane departure warning, anti-lock brakes, adaptive cruise control and traction control that can reduce the number of traffic accidents. All of these systems require complex electronic components such as high-speed processors, memory, controllers and sensors to ensure the reliability and safety of a vehicle.

Considering the complexities of the modern age semiconductor supply chain, which includes fabless design houses, foundries, integrated device manufacturers (IDMs) and outsourced assembly and test (OSAT) suppliers, there is renewed emphasis on unit-level traceability (ULT). From an innovation perspective, the global automotive industry is in a perpetual state of change; while the underlying fundamental principles such as improving quality, reducing costs and optimizing processes can only be strengthened through a strong traceability initiative along the entire supply chain. As an assembly and test partner to automotive IC suppliers, Amkor offers ULT as an added benefit to our automotive assembly and test services.

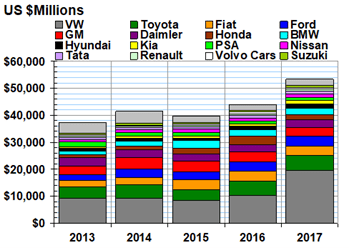

The motivation of traceability from automotive OEMs and Tier 1 suppliers arises from either warranty (field failures) concerns or pre-delivery (0 km or 0 hr) failures. According to one automotive OEM warranty report2, approximately $40 billion was paid out as claims annually by the car companies over the last 5 years as shown in Figure 1. Note that the payout in 2017 was inflated significantly due to diesel emission scandal of Volkswagen.

Fig. 1: Annual Automotive Warranty Costs. (Source: Warranty Week2)

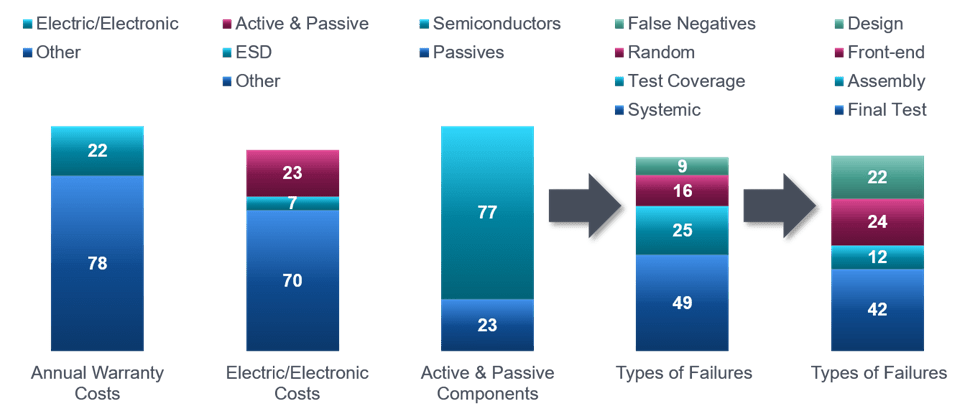

To further understand the impact of warranty claims and the role of semiconductors, analysis of the estimates from the semiconductor management group at a leading European OEM provides an estimate that for every $1 of warranty costs, nearly 4 cents can be attributed to the failures of semiconductors. While the financial impact is clear, it may also result in reputation loss to OEMs as well as Tier 1 and Tier 2 (component) suppliers and puts significant stress on supply chain management.

Fig. 2: Annual Automotive Warranty Costs Breakdown. (Data presented by ELES Semiconductor at Automotive Electronics Reliability Workshop, courtesy of Semiconductor Management at BMW Group3)

In the aftermath of a warranty problem, the chip supplier embarks on an eight disciplines (8D) problem solving effort to find the root cause and devise a short-term fix and a long-term solution. Generally, OEMs require an 8D report in less than 10 days, especially if the failures are safety related. If the failure is related to a semiconductor component, ULT can help quickly pinpoint origins of the failed components. For ULT to be effective, manual processes must be replaced with automated ones, capturing, storing, and managing information automatically. A sample ULT system flow is shown in figure 3. While there is huge demand for traceability, the biggest challenge remains in identifying the protocols for manufacturing data across the supply chain. Formatting such diverse data sets and subsequent communication to all stakeholders is challenging.

Fig. 3: Unit Level Traceability (ULT) System Flow.

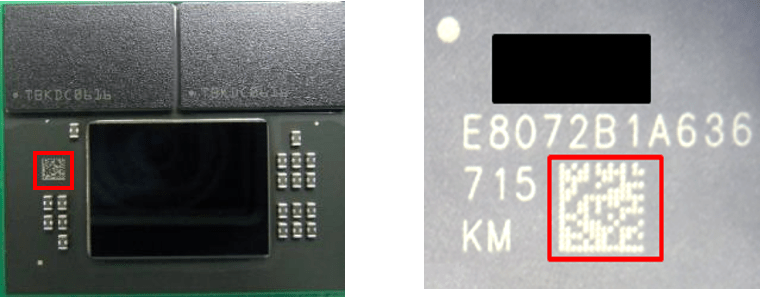

Amkor’s ULT provides information from an assembled IC either electrically or using a 2D barcode marked on top of the device as shown in figure 4. The data includes die information such as wafer ID, die position (co-ordinates), substrate or leadframe strip information and equipment used for various steps in the assembly and test process. A modified assembly process flow for a leadframe product may include additional 2D laser mark on the leadframe, automated optical inspection (AOI) and open-short testing for robust control. In this approach, 100% manual optical inspection has been replaced with AOI. For the customers whose product is not turnkey, an additional open-short sample test provides fast feedback on maverick lots which deviate from yield targets. As the package moves along the assembly line, a 2D barcode reader verifies whether the strips are in the correct lot and based on processing information from each manufacturing step, final 2D barcodes are laser marked on top of the package.

Fig. 4: Examples of Packages with 2D Barcodes for ULT.

To ensure stringent automotive requirements for complicated products such as system-in-package (SiP), a sophisticated ULT may be required. For example, RFID cards are assigned to each assembly lot to track the product through the assembly process and ensure that the product follows a specified manufacturing flow. Prior to mounting components on the printed circuit board (PCB), the substrate is laser-embossed with a unique two-dimensional identification (2DID) serial number for each module. This allows the collection of ULT data at key process steps, providing full traceability of the module assembly. After all the components are placed on the PCB, the units go through the reflow furnace where components are soldered to the board. To verify component placement after reflowing, the units go through AOI where each 2DID is scanned for ULT. The AOI tool inspects solder joints, detects any missing components, and verifies accurate component placement. Since the solder joints on ball grid array (BGA) components are not visible, 100% of the units would also go through automated x-ray inspection. Finally, the units go through “open short” tests, where they are individually tested and sorted. At Amkor, ULT services include not just data collection of processes, materials, and equipment history but also real-time retrieval and transmission.

For automotive customers, the ULT data retention is at least 15 years compared to 5 years for commercial products. Further, the benefits of ULT are not limited to providing traceability in manufacturing operations but also in shortening product development cycles. Data such as strip map, wafer map, bill of materials and the resulting assembly and test yields can be datamined appropriately to shorten engineering data turns via data analytics. This type of ULT system ensures that the product meets ‘zero defect’ quality standards while providing real-time access to the manufacturing information with ultimate goals of increased customer satisfaction and meeting compliance mandates.

References:

[1] https://blog.semi.org/technology-trends/device-traceability-and-semis-single-device-tracking-initiatives

[2] https://www.warrantyweek.com/archive/ww20180816.html

[3] Data presented by ELES Semiconductor at Automotive Electronics Reliability Workshop, courtesy of Semiconductor Management at BMW Group