Sequans Communications S.A. (SQNS) is based in Paris, France, and develops, designs, and supplies 5G and 4G modules and chips for massive, broadband, and critical Internet of Things (IoT) markets that are “fully optimized for non-smartphone devices.”

The company’s product portfolio consists of integrated circuits (IC) of baseband processors and radio frequency (RF) transceivers, machine-to-machine (M2M) modules that incorporate these ICs along with radio front-end subsystems, and software.

First Quarter Results and Q2 Outlook

In the first quarter, the company posted revenues of $12.3 million, a jump of 40% year-over-year. Losses narrowed from $15.3 million in the first quarter of FY20 to $11.4 million in Q1 FY21. The company reported a Q1 diluted loss of $0.33 per ADS versus a diluted loss of $0.64 per ADS in the same quarter last year.

When it comes to the company’s outlook for the second quarter, SQNS stated in its earnings press release, “Despite the continued supply chain constraints for materials, and factoring in the risk related to the portable router business, management is targeting a 10% sequential increase in revenue.”

Supply Chain Constraints

The company also stated at its earnings call that supply chain constraints delayed around $2 million worth of massive IoT product shipments, resulting in the company’s Q1 revenues falling 22% quarter-on-quarter.

Last month, Needham analyst Rajvindra Gill reiterated a Buy and a price target of $11 on the stock. This implies 80.9% upside potential from current price levels. The analyst interacted with Sequans CEO Georges Karam and CFO Deborah Choate at the Virtual Needham TMT Conference.

In a note to investors, Gill commented on the supply chain constraints saying, “wafer capacity has been harder to secure for 2H vs. 1H21, and PCB [printed circuit board]/substrate supply is becoming an issue and the company has been forced to pursue second sources to meet their needs. Overall, demand has been reported to be about 25% higher than supply at TSMC [Taiwan Semiconductor Mfg. Co.], though the CEO reported that they are generally happy with how TSMC has been working on order fulfillment.”

Product Revenue Pipeline

SQNS stated at its earnings call that the company has seen momentum in its sales since the beginning of this year. The company’s product revenue pipeline grew 20% year-over-year to $600 million in Q1, and 80% of this pipeline is in the massive IoT category.

Sequans Communications’ CEO, Georges Karam also said at the earnings call that the revenue pipeline indicates that the company is on track to achieve annual revenue growth of 50% between 2020 to 2024.

Gill commented on the revenue pipeline, “Additionally, this $600M can be looked at as 40% design wins and 60% customer engagements – the company pointed out that this $600M figure is not a backlog.”

Massive IoT

Sequans’ Massive IoT product category saw robust revenue growth of 100% year-over-year with both Cat1 and Cat-M/NB categories contributing to growth. Cat1 is the company’s category 1 chipset, Calliope, while the Cat-M/NB category is the company’s single-chip flagship solution, Monarch.

Sequans explained this further telling analysts at its earnings call, “Cat 1 category is required for specific Massive IoT applications where a guaranteed speed above 100 kb/s and/or voice feature is needed, functionalities not supported by Cat M/NB. Such applications include specific security and metering devices, and consumer terminals such as wearable and hearable supporting voice and streaming music.”

Gill sees Sequans’ massive IoT as a key driver for growth and said, “Medical applications (smart health and well-being) have seen more demand than management initially expected and Smart Home applications are gaining traction (Comcast is a customer for the latter category). With regard to their vertical (e.g. satellite) business, the company has reported that it is engaged in a project with Lockheed Martin.”

Broadband IoT

Sequans stated at its earnings call that the company’s Broadband Citizens Broadband Radio Service (CBRS) business is expected to grow quarter-on-quarter this year, “making CBRS a new growth engine for Broadband IoT.”

The company also said that its revenues for this business could potentially double this year compared to last year.

Gill commented on the business prospects of broadband IoT, “5G private networks in the US in college campuses, airports, stadiums, factories and jails are gaining traction and Sequans reports 16+ customers for various projects in the space. Although supply chain issues have put a damper growth here, management expects that this business could double next year. The competitive landscape is quite limited outside of China for similar projects, according to the CEO.”

Legacy Broadband Portable Router Business

The company’s legacy broadband portable router business is in decline in line with the company’s forecast as demand for these routers has fallen compared to last year. To add to its woes, in April this year, Verizon (VZ) announced a voluntary recall of the portable router, Jetpack, due to a battery heating issue.

Jetpack is manufactured by Franklin Wireless and is fitted with a Sequans modem. The company talked about this issue at its earnings call saying, “At this time, we are not sure when shipments of the Jetpack will resume and how sales to Franklin will trend in the second half of 2021. Still, this new factor may impact 2021 revenue by up to $6 million.”

Gill commented, “current gains are driven by expansion of Massive IoT related sales, but management suggested that the router/Broadband IoT business could see some “nice surprises” in 2H21. On a whole-company basis, management suggested that they are targeting a 48% gross margin at this time.”

Microcontroller Partnerships

The company is targeting more partnerships with microcontroller vendors while expanding its existing partnerships with current vendors including Microchip (MCHP), NXP Semiconductors (NXPI), and Renesas Electronics (RNECF).

Microcontroller partnerships are required as these vendors integrate the company’s chips with the vendors’ microcontrollers in IoT devices. (See Sequans Communications SA stock analysis on TipRanks)

Gill commented on these partnerships, “these partnerships bring sales/channel capabilities plus software expertise to complement the wireless-silicon capabilities of Sequans.”

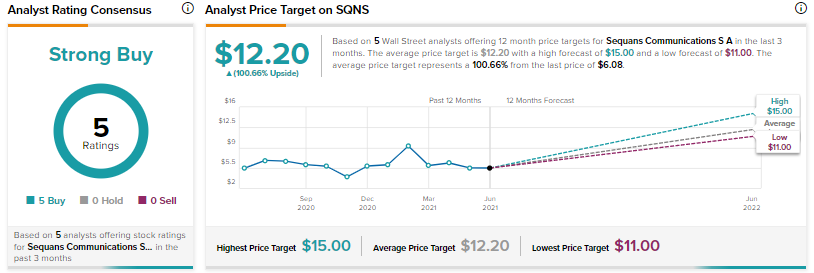

Consensus among analysts on Wall Street is a Strong Buy based on 5 Buys. The SQNS average analyst price target of $12.20 implies approximately 100.6% upside potential to current levels.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.