While supply constraints that are impacting some players will continue into the next year, the strong demand environment is leading to price increases and long-term supply agreements (for some).

The longer-lasting impact of the pandemic is overwhelmingly positive for the industry because it provides the building blocks of technology that everyone is relying on for maintaining social distancing and remote operations.

Moreover, technological advancements in the way we do computing, as well as artificial intelligence, Internet of Things, 5G, driverless cars and a host of other things that will greatly increase our reliance on the digital world are secular drivers for the industry.

Therefore there are huge prospects in this market and it’s a place we should all be in. Our current picks are Maxlinear, MACOM Technology, Microchip, NXP Semiconductors and ON Semiconductor.

About The Industry

Contents

We generally use our electronic gadgets without thinking, expecting them to understand our operating environment, read our commands correctly record and store, retrieve and process the information we throw at them.

What goes on behind the process is enabled by semiconductor technology, whether analog (enabling the recording and measurement of real world information), digital (processing information available in machine-readable language) or mixed signal (enabling conversion of analog signals to digital or digital to analog among other things). Most electronic gadgets use a combination of these devices.

This industry is cyclical, with a period of expanding capacity when supply outpaces demand and a then period of the growing demand exceeding capacity. So there is price elasticity. Seasonality is balanced by serving multiple end markets.

Factors Driving The Industry

- The increasing use of electronics in vehicles, airplanes and defense equipment; increased factory automation; greater penetration of smartphones, tablets, notebooks, PCs and all manner of personal computing and other personal devices and smart household appliances; communications infrastructure moving to 5G; greater reliance on cloud infrastructure; the advent of artificial intelligence (AI), the Internet of Things (IoT), more advanced medical devices, EVs, self-driving cars etc is leading to unprecedented demand for semiconductor chips. Since we simply aren’t making as many chips as we need, supply chains are being optimized to the maximum. Since the pandemic hit in such a situation, manufacturers had no option but to divert production to things immediately in demand, which in this case were the cloud, household items, personal computing and devices, etc. But when people wanted to move out again, they preferred their own transportation, which increased demand for vehicles. But production diverted to these other things simply can’t be redirected at such short notice. And this is the reason behind the global chip shortage. Company chiefs are guessing that the great shortage will continue well into next year despite huge efforts to bring new capacity online. And of course, this will lead to strong pricing.

- With vaccines rolling out rapidly, many segments of the economy that were only partially operational are expected to open up while not all the work and school that moved home is coming back. This is leading to the hybrid model, where more people move out of their homes more often but not all the time. This is likely to expand the overall electronic footprint, which should also be positive for the industry. So, while demand for traditional computing equipment like PCs and newer-age tablets should remain strong as more work and education is done at home, consumer devices incorporating newer technologies to enable more experiences, will continue to join. The number of semiconductors per device and their complexities will constantly increase. R&D budgets focused on responding to increased competition and the expanding scope of digitization will therefore also increase.

- Secular drivers for the industry are like data center growth (from the continuing shift in workloads to the cloud, which was accelerated by the virus), the advent of artificial intelligence (which is huge because it will permeate every aspect of life and living and is still a market in the making) and IoT (which is another market in the making and will tremendously expand the scope of computing).

- The adoption of 5G communications technology, enabling 10X the data rate as 4G, will be a huge boost to analog-mixed signal sales both in base stations and end devices. Because of the multiple input (MI) and multiple output (MO) streams the technology will enable in base stations, demand for sensors and power management analog including envelope tracking chips (to manage excess power flow and thus reduce heating), as well as gallium nitride (GaN) materials will increase. Moreover, since 5G is only involved in short range signals, it will not totally replace 4G but will supplement it. So it will be additive in terms of component demand. This is also a brighter spot, but a slowdown until the virus impact is clearer seems inevitable.

- Industry consolidation continues as the cost and complications of making chips rises in an environment where the adoption of semiconductors in devices of varying value requires prices to decline. However, M&A activity will be increasingly difficult because a lot of consolidation has already happened. At the same time, the goals of expanding capabilities and acquisition of key talent remain as important as ever.

- There’s also a longer-term challenge with respect to China, which is bringing new fabs online with the goal of becoming number one in several key technologies. The resultant locking of horns with the U.S. can cause disruptions.

Zacks Industry Rank Indicates Attractive Prospects

The Zacks Semiconductor – Analog and Mixed industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #36, which places it at the top 14% of more than 250 Zacks-classified industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates attractive near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions over the past year, analysts appear to have gotten more and more enthusiastic about this group’s earnings growth potential. So 2021 Estimates have risen 32.3% over the past year, while for 2022 they’ve risen 21.0%.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Leads on Stock Market Performance

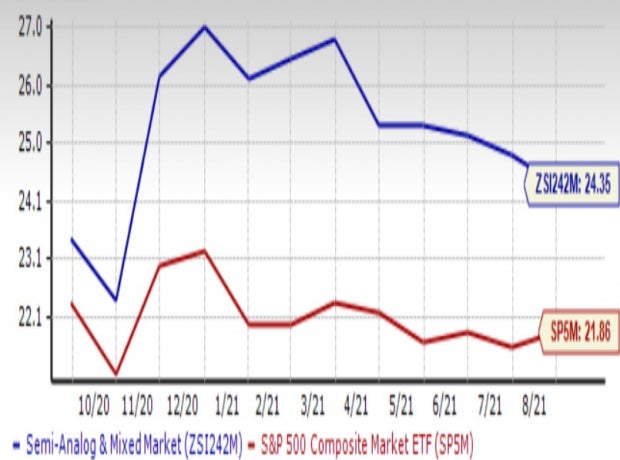

The Zacks Semiconductor – Analog and Mixed industry has been ahead of the broader Zacks Computer and Technology Sector as well as the S&P 500 index over the past year.

Overall, the industry added 52.1% to its value over this period compared to the broader sector’s 34.1% gain and the gain of 29.7% for the S&P 500.

One-Year Price Performance

Image Source: Zacks Investment Research

Industry’s Current Valuation

On the basis of forward 12-month price-to-earnings (P/E) ratio, which is a commonly used metric for valuing semiconductor companies, we see that the industry is currently trading at a 24.35X multiple compared to the S&P 500’s 21.86X. It is however slightly undervalued compared to the sector’s forward-12-month P/E of 28.53X.

The industry is currently trading below its median value of 25.32X. The industry has traded in a fairly tight range of 22.43X to 26.96X over the past year.

Forward 12 Month Price-to-Earnings (P/E) Ratio

Image Source: Zacks Investment Research

5 Stocks Offering Exposure To The Industry

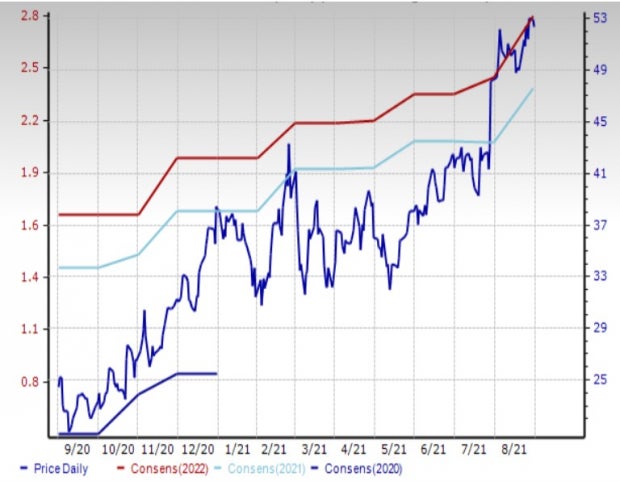

MaxLinear, Inc (MXL – Free Report) : The company offers small form factor, low-power, radio-frequency (RF) analog and mixed signal semiconductor products including receivers and receiver systems-on-chip (SoCs). Its products capture and process digital and analog broadband signals to be decoded for various applications, enabling the display of broadband video in a wide range of electronic devices, including cable and terrestrial set top boxes, digital televisions, mobile handsets, personal computers, netbooks and in-vehicle entertainment devices.

The company has exposure to the broadband (its biggest market), infrastructure (data center and 5G) and industrial and other markets, where it is seeing very strong demand. In addition to this strength, its strong product lineup and its ability to increase platform level silicon content is helping it take additional market share and generate triple digit revenue growth.

So it beat estimates by 6.0% in the last quarter, after which the current year EPS estimate of this Zacks Rank #1 (Strong Buy) stock increased from $2.09 to $2.37, an increase of 13.4%.

The shares are up 115.2% over the past year.

Price and Consensus: MXL

Image Source: Zacks Investment Research

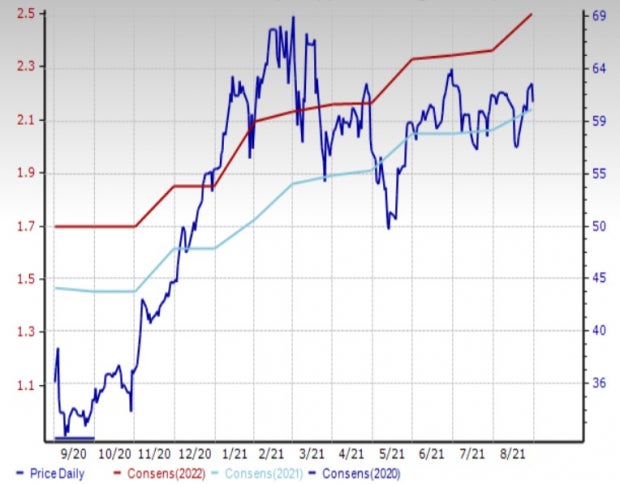

MACOM Technology Solutions Holdings (MTSI – Free Report) : The company offers power analog chips including radio frequency (RF), microwave and millimeter wave semiconductor devices and components for application in optical, wireless and satellite networks. Its primary customers are in the telecom (39% revenue share), industrial and defense (37%) and data center (24%) markets.

So MTSI operates in attractive markets that have significant growth potential. The company is focused on bringing to market its new and more differentiated products at an accelerated pace so as to capture a bigger share of its addressable market that management estimates at around $5 billion. It already has product content in antenna systems as well as in front haul, mid haul and metro long haul optical systems. So new products, set to release over the next 6-12 months should drive further share gains. At the same time, it also continues to invest in its U.S. fabs as a strategy for differentiating its products.

After topping estimates by 7.6% in the last quarter, the current year EPS estimate of this Zacks Rank #2 (Buy) stock increased by 8 cents, or 3.9%.

The shares are up 71.4% over the past year.

Price and Consensus: MTSI

Image Source: Zacks Investment Research

Microchip Technology Incorporated (MCHP – Free Report) : Microchip develops and manufactures microcontrollers, memory and analog and interface products for embedded control systems, which are small, low-power computers designed to perform specific tasks.

The company is seeing particular strength in the automotive, industrial and consumer markets, which are seeing above-seasonal strength. Low channel inventories and supply constraints are raising some material and subcontracting costs while high demand is allowing price increases.

Despite the extension of capacity, the exceptionally high demand is allowing the company to build backlog extending well beyond the current quarter. Moreover, most of the backlog, especially in constrained areas, is coming through its Preferred Supply Program, which further improves visibility. It is also refinancing its debt on more favorable terms while extending maturities. At the end of the last quarter, management also announced a dividend increase.

The company topped the Zacks Consensus Estimate by 4.2% in the last quarter. The Zacks Consensus Estimate for the current year increased 59 cents (7.5%) in the last 60 days.

The shares of this Zacks Rank #2 company are up 44.3% over the past year.

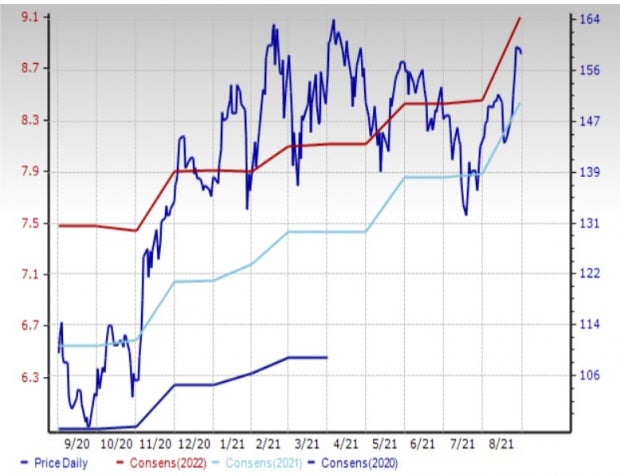

Price and Consensus: MCHP

Image Source: Zacks Investment Research

NXP Semiconductors N.V. (NXPI – Free Report) : The company offers high performance mixed signal and standard product solutions leveraging its RF, analog, power management, interface, security, as well as digital processing capabilities. These solutions are used in a wide range of markets, including automotive, wireless infrastructure, lighting, industrial, mobile, consumer and computing.

The strong demand NXPI is currently seeing is expected given its significant exposure to auto and industrial end markets. The company has prepared to ship higher volumes given the constrained environment and expects the situation to generate additional revenue through this year and well into the next.

It beat estimates by 3.0% in the last quarter. The Zacks Consensus Estimate for the current quarter has jumped 69 cents (7.2%) in the last 60 days.

The shares are up 70.6% over the past year.

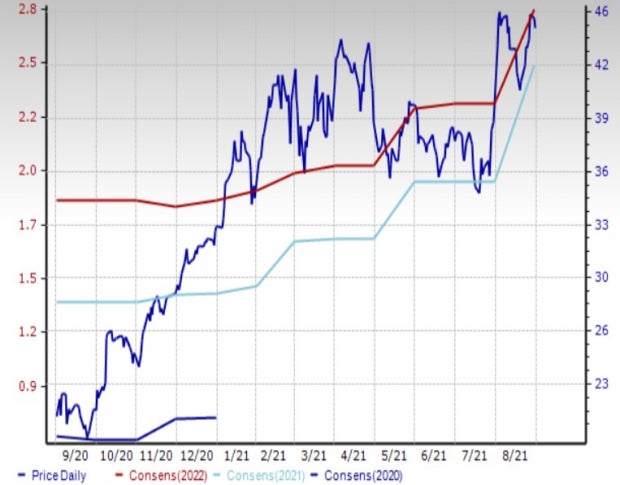

Price and Consensus: NXPI

Image Source: Zacks Investment Research

ON Semiconductor Corporation (ON – Free Report) : The company is an original equipment manufacturer (OEM) of a broad range of discrete and embedded semiconductor components, including power management, logic, signal processing, memory and application specific integrated circuits (ASICs). It also offers foundry services.

The company is another beneficiary of the current strength in the automotive and industrial markets, both of which are in the middle of a strong growth phase. Additionally, its highly differentiated power management solutions have enabled it to generate new design wins and market share gains. With auto customers entering into long-term supply agreements, the company stands to benefit from the improving visibility and better asset allocation. On Semi is also well positioned to capitalize on the emerging EV opportunity, as well as the rapidly expanding alternative energy market (mainly solar farms). So management expects that the record revenues generated in the last quarter will grow into more of a trend, at least through the first half of next year.

ON Semi beat June quarter estimates by 28.6% after which the estimates for this Zacks Rank #2 company increased 29.5%.

The shares are up 109.3% over the past year.

Price and Consensus: ON

Image Source: Zacks Investment Research