The pandemic did create some problems for players in this industry because most of the manufacturing is in Asian countries where it first hit. But the problems were short-lived because these countries also recovered faster.

The longer-lasting impact was overwhelmingly positive because these are the companies responsible for the building blocks of technology that everyone is relying on for maintaining social distancing and remote operations.

Moreover, there’s no reason for any softness in the current strength because of ongoing changes in the way we are doing things that will greatly increase dependence on automation and artificial intelligence.

Therefore there are huge prospects in this market and it’s a place we should all be in. Our current picks are MACOM Technology Solutions, Inphi Corporation and Maxim Integrated Products.

About The Industry

We generally use our electronic gadgets without thinking, expecting them to understand our operating environment, read our commands correctly and store, retrieve and process the information we throw at them.

But what goes on behind the process is complicated, and enabled by semiconductor technology, whether analog (enabling the recording and measurement of real world information), digital (processing information available in machine-readable language) or mixed signal (enabling conversion of analog signals to digital or digital to analog among other things). So most electronic gadgets use a combination of these semiconductor devices.

The industry is cyclical, making for periods of expanding capacity and supply that outpace demand followed by periods during which the growing demand matches then exceeds supply. So there is a certain elasticity in prices. Moreover, these semiconductor components have wide application across automotive, communications, computing/cloud/data center, industrial, medical, IoT and other markets, so players can serve multiple markets that offset their individual seasonality.

Some of the leading players in the industry include Analog Devices (ADI) and Maxim Integrated Products (MXIM – Free Report) .

Here are the major themes in the industry:

- While the coronavirus did create some issues for the industry at first (just as it did for every other industry), it quickly became clear that semiconductors constituted the basic technology that is imperative to solve the problems thrown up by the pandemic. So the supply chain issues and problems related to the manufacturing base being largely in Asia became non-issues, with demand accelerating many times over as people used technological platforms to communicate, entertain and work.

- Secular drivers like data center growth (from the continuing shift in workloads to the cloud, which was accelerated by the virus), the advent of artificial intelligence (which is huge because it will permeate every aspect of life and living and is still a market in the making) and IoT (which is another market in the making and will tremendously expand the scope of computing) remain. Demand for traditional computing equipment like PCs and newer-age tablets should remain strong as more work and education is done at home. As consumer devices incorporate newer technologies to enable more experiences, the number of semiconductors per device and their complexities will constantly increase. R&D budgets focused on responding to increased competition and the expanding scope of digitization will therefore increase.

- Semiconductor application in the automotive segment is poised to see very rapid growth as infotainment and smart dashboards are expected to make way for much higher volumes of chips that will be necessary to equip/enable automated/self-driving cars, electric/solar-powered cars and so on.

- The adoption of 5G communications technology, enabling 10X the data rate as 4G, will be a huge boost to analog-mixed signal sales both in base stations and end devices. Because of the multiple input (MI) and multiple output (MO) streams the technology will enable in base stations, demand for sensors and power management analog including envelope tracking chips (to manage excess power flow and thus reduce heating), as well as gallium nitride (GaN) materials will increase. Moreover, since 5G is only involved in short range signals, it will not totally replace 4G but will supplement it. So it will be additive in terms of component demand. This is also a brighter spot, but a slowdown until the virus impact is clearer seems inevitable.

- While industry consolidation continues as the cost of making chips rises, M&A activity will be increasingly difficult because a lot of consolidation has already happened. At the same time, the goals of expanding capabilities and acquisition of key talent remain as important as ever.

The challenge of rising cost and complications of fabricating chips remains while their broader adoption across devices of varying value requires prices to decrease.

There’s also a longer term challenge with respect to China, which is bringing new fabs online with the goal of becoming number one in several key technologies. The increased supply will could down prices and dampen sales for American players. The outcome of the ongoing trade war also increases uncertainties.

Zacks Industry Rank Indicates Attractive Prospects

The Zacks Semiconductor – Analog and Mixed industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #55, which places it at the top 22% of more than 250 Zacks-classified industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates attractive near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts were losing confidence in this group’s earnings growth potential until around May. Estimates have risen 19.3% since then, netting a decline of 13.2% for the past year.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

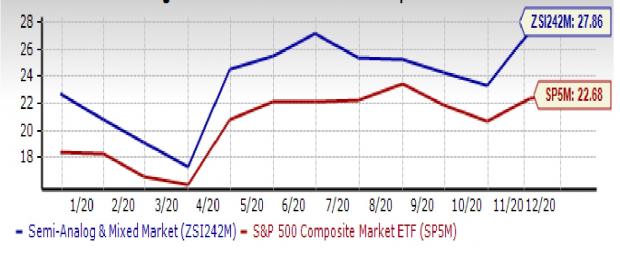

Industry Ahead on Stock Market Performance

The Zacks Semiconductor – Analog and Mixed Industry has narrowly railed the broader Zacks Computer and Technology Sector but has remained mostly ahead of the S&P 500 index over the past year. The industry also appears more volatile, rising a bit more than both the S&P and the sector in stronger periods and falling a bit more in down periods.

Overall, the industry added 35.2% to its value over this period compared to the broader sector’s 38.8% gain and the S&P 500 index’s gain of 15.9%.

One-Year Price Performance

Industry’s Current Valuation

On the basis of forward 12-month price-to-earnings (P/E) ratio, which is a commonly used multiple for valuing semiconductor companies, we see that the industry is currently trading at 27.9X compared to the S&P 500’s 22.7X. It is however slightly undervalued compared to the sector’s forward-12-month P/E of 28.0X.

The industry is currently trading at the high end of its annual range of 17.7X to 27.9X and well above its median of 24.5X, as the chart below shows.

Forward 12 Month Price-to-Earnings (P/E) Ratio

3 Stocks Offering Exposure To The Industry

MACOM Technology Solutions Holdings (MTSI – Free Report) : The company develops and produces power analog chips including radio frequency (RF), microwave and millimeter wave semiconductor devices and components for application in optical, wireless and satellite networks. Its primary customers are in the telecom (39% revenue share), industrial and defense (37%) and data center (24%) markets.

So MTSI operates in attractive markets that have significant growth potential. The company is focused on bringing to market its new and more differentiated products at an accelerated pace so as to capture a bigger share of its addressable market that management estimates at around $5 billion. It already has product content in antenna systems as well as in front haul, mid haul and metro long haul optical systems.

So new products, set to release over the next 6-12 months should drive further share gains. At the same time, it also continues to invest in its U.S. fabs as a strategy for differentiating its products.

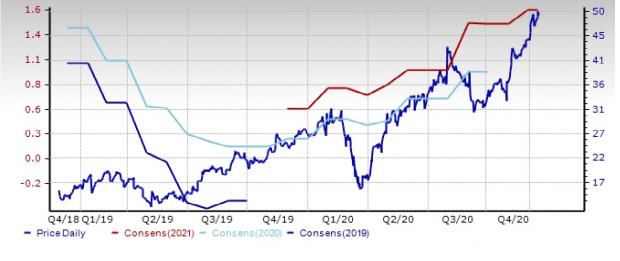

After topping estimates by 5.3% in the last quarter, the current year EPS estimate of this Zacks Rank #1 stock increased 10.1% from $1.48 to $1.63.

The shares are up 81.2% over the past year and up 206.5% from their March lows.

Price and Consensus: MTSI

Inphi Corporation (IPHI – Free Report) : Inphi is a fabless provider of high-speed analog semiconductor solutions for the communications and computing markets. Its products are used in telecommunications transport systems, enterprise networking equipment, datacenter and enterprise servers, storage platforms, test and measurement equipment and military systems.

Marvell has agreed to buy the company for $10 billion in cash and shares (to close in the second half of 2021), which is the main reason for the way shares have appreciated this year. IPHI is also attractively positioned to benefit from the new normal as it has a broad range of products targeting the two revolutions in cloud computing and 5G.

The company topped the Zacks Consensus Estimate by 2.3% in the last quarter, after which the current year EPS estimate of this Zacks Rank #2 stock increased a few cents from $3.29 to $3.32.

The shares are up 111.0% over the past year and up 376.8% from their March lows.

Price and Consensus: IPHI

Maxim Integrated Products, Inc. (MXIM – Free Report) : Maxim Integrated Products, Inc. is an original equipment manufacturer (OEM) of semiconductor analog and mixed signal integrated circuits (ICs) like analog-to-digital converters, amplifiers and comparators, communications devices, data converters and management components, sensors and wireless products for consumer, computing, industrial, automotive and communications markets.

The company is seeing broad-based demand across all its served markets, with particular strength in infotainment, driver assistance and electric vehicle content in the Automotive market, and across smartphones, gaming, wearables, tablets and broad-based personal electronics in the Consumer market.

Maxim will merge into Analog Devices in the summer of 2021 if it obtains regulatory approval from major markets like China and the EU. Shareholders at both companies have approved the merger.

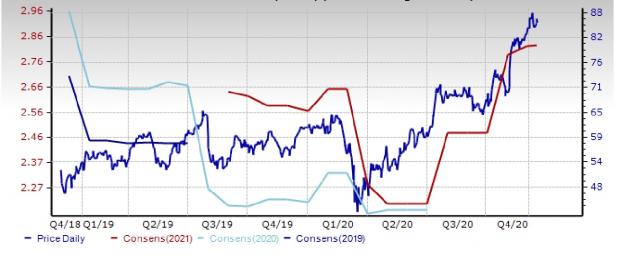

The company topped the Zacks Consensus Estimate by 24.1% in the last quarter, after which the current year EPS estimate of this Zacks Rank #2 stock increased 14.2% from $2.47 to $2.82.

The shares are up 41.1% over the past year and up 77.4% from their March lows.

Price and Consensus: MXIM

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.